Small business owners are often caught in a bundle of activities aimed towards business growth, with very little time or money to assign resources towards monitoring their cash flow. At this stage, there are many chances to derail your business due to mismanagement of cash. A study from Intuit found that 61% of small businesses around the world struggle with cash flow.

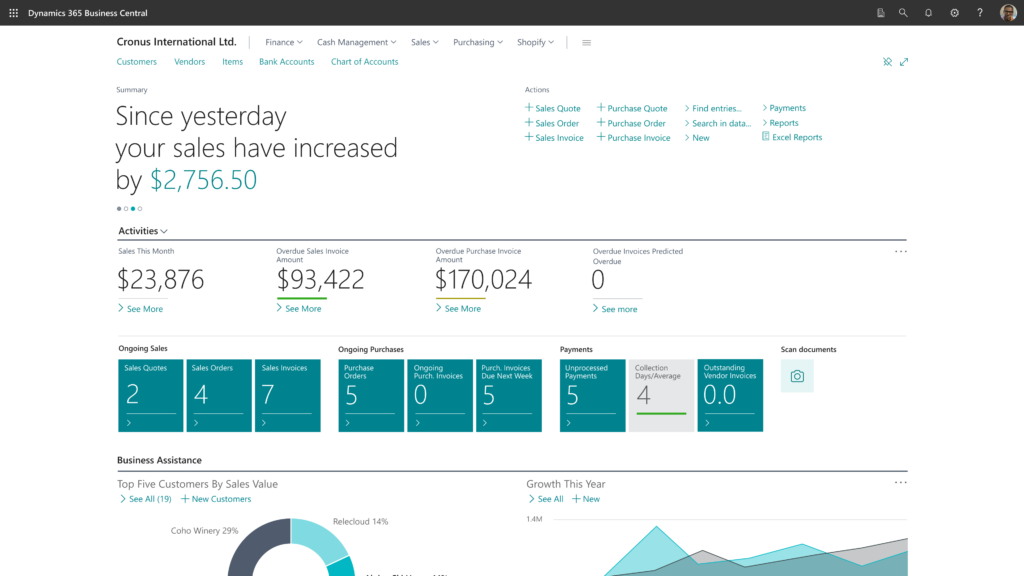

Therefore, the inclusion of Microsoft Dynamics 365 Business Central remains a comprehensive solution for all business needs. Being an effective financial management solution, it is critical for the success of any business. Positive cash inflows and outflows adequately allow businesses to make informed decisions. It also helps financial business experts with a thorough understanding of the current business environments, business activities, and company management to run a business.

Nevertheless, it can be challenging to evaluate the accuracy of financial forecasting after the financial results have been realized, which can result in uncertainty and potential discrepancies.

To combat this struggle and stabilize your cash flow, here is how the inclusion of Microsoft Dynamics 365 Business Central will help you eliminate the mistakes and provide solutions for your business model.

Manually Collecting and Delivering Invoices

Many small businesses initially begin to manually collect and deliver the invoices. But it is full of complexities and challenges. For instance, all the invoices may or may not follow a standard template. Also, figuring out the details from every invoice will consume a lot of time that will end up affecting other business aspects. Every year, so many companies fall prey to the tedious and error-prone task thereby incurring costs to the financial books.

Microsoft Dynamics 365 Business Central has a dedicated finance module to handle the finances of your businesses.

- Gain control of your financial data

- Expand your business to the global market

- Speed up reporting and financial close

- Achieve maximum financial visibility

- Optimize your reporting and make better financial decisions

This enables organizations to take their time away from a collection agent’s time spent communicating with customers to collect past due balances or resolve invoice disputes. Instead, they can focus on other financial aspects by streamlining business operations, involving financial structures, and global expansion while helping companies manage organizational risk.

Ongoing Monotonous Tasks

Financial advisors continue to proactively automate their client billing processes but don’t implement the same level of automation for other administrative tasks such as performance reporting or compliance. Fortunately, with the inclusion of Microsoft Dynamics 365 Business Central, a major chunk of the ongoing business processes can be automated.

The tedious task of automating processing by setting up the ‘payment terms and schedules will allow business users to automatically generate requests and initiate disbursements based on these schedules. This helps ensure that transactions are made on time and reduces the risk of missed payments.

This further comes with a high degree of customization to meet the firm’s unique business needs. In all, automating your back-office tasks will save you time and reduce the chances of human error.

Incorrect use of Accounting Principles

Financial and accounting arenas are full of compliance standards and principles that are a significant part of running a successful business. Misapplying accounting principles, such as the matching principle or the principle of conservatism, can lead to significant discrepancies in financial reporting, often leading businesses to fall into a lawsuit.

However, Microsoft Dynamics 365 Business Central strictly adheres to industry-specific standards like GAAP and IFRS in security and compliance. Compliance is a topic of increasing interest, and Business Central contains functionality that makes it easy for customers to comply with compliance and regulatory legislation.

Unforeseen Expenses in ERP Solutions

Small businesses tend to come across unforeseen expenses, and therefore it becomes a humungous challenge to deal with and eliminate it. Even though there is no crystal ball to predict the future, some changes to your financial practices can always bring a positive change to your financial standings.

In the arena of multiple ERP software solutions, it is common to find unsatisfactory business owners, who are struggling with the onboarding, implementation, and live phase of a certain ERP solution. While it may have been an affordable solution at the time of making the right pick, it may fail in the coming phases.

However, Microsoft Dynamics 365 Business Central is a promising solution, that can encapsulate the entire business processes as one. Forbes also listed Microsoft Dynamics 365 Business Central as the best cloud ERP Software (overall) of 2023.

Following a swift implementation process, there aren’t any unforeseen expenses associated with D365 Business Central that can simply pop up and startle you. Nevertheless, cloud functionalities, tailored implementations, and added support all widen your horizon to exponentially grow your business.

Finding the Right Practitioner for Help

Business owners essentially have their focus on finding the right ERP solution and looking into the offerings that it provides. With a monumental focus on just this side, they overlook the equal need to hire a promising team of practitioners who can help them with a seamless implementation process:

- Accurate and complete data migration to avoid any disruptions in business

- Ongoing employee support and assistance for swift change management

- Layout of specific requirements and challenges for a detailed integration plan

- Calculating the opportunity cost between specialized knowledge and expertise of resources with ERP software

In all, the right ERP experts will develop, deploy, and support your implementation from beginning to end, and after. Compromising on the implementation skillset is prone to take a toll on your finances and hinder growth for the time being.

Minimize Financial Turbulence with Dynamics Solution and Technology

Microsoft Dynamics 365 is a comprehensive solution for all your financial business needs. From monitoring your global financial operations in real-time, predicting outcomes, and making data-driven decisions that drive business agility and growth, it is the one for you.

Dynamics Solution and Technology has helped its clients open new horizons of development for organizations with a global footprint. Infusing the strengths of the Microsoft Dynamics 365 suite into the business framework, our expertise helps to add proficiency and accuracy via tailored support and customizations.

Implementing a single, comprehensive, customer-centric financial platform is just a click away. Contact now!