Digital transformation is a necessity in most industries, and finance is no exception. Your financial strategy will only be as effective as the data which supports it.

Dynamics 365 Finance’s primary competency is that it eliminates risk, automates, and modernizes your worldwide financial operations in accordance with the FASB and IFRS 16 accounting rules.

Asset Leasing in Dynamics 365 facilitates very smoothly the administration and automation of financial activities regarding leased assets in a variety of industries, such as real estate or fleet operations, for a variety of industry-oriented enterprises worldwide.

In Dynamics 365 Finance, what is Asset Leasing?

Asset Management in Microsoft Dynamics 365 Finance mainly involves leasing to help you to manage, track, and automate financial transactions for chartered assets. It collects and processes lease data and aids in the generation of journal entries throughout the lifespan of the lease, from initial recognition to monthly journal entries, impairment, and termination.

Microsoft Dynamics 365 asset leasing follows International Accounting Standards (IFRS 16) and US GAAP (ASC 842). It collaborates with other Dynamics 365 Finance components i.e. Fixed Assets, Accounts Payable, and General Ledger.

How can Asset Leasing help your business grow incrementally?

Asset Leasing Elements

With its boundless possibilities, Microsoft Dynamics 365 enables the integration of Asset leasing and general ledger and amalgamates all submitted lease transactions to update your chart of accounts, lowering financial risk.

Every function is categorized to give a convenient and clear understanding. Like fixed Assets, you may track the trail of fixed asset leases with post-right-of-use asset transactions, including the asset’s initial measurement, depreciation, and impairment. The feature also connects with Accounts payable in order to track lessor bills and take future payments from there.

For off-balance sheet leases, the system computes the straight-line lease expenditure over the shorter of the asset’s economic life or the lease period. Lease adjustments account for contract changes such as lease extensions or expansions but also offset non-recoverable expenditures.

A leased asset contains the following main components.

- Lease Agreement

- Lease calculation and classification per accounting standard

- Lease transactions

What You Should Also Know

It is critical to recognize and comprehend the significance of certain aspects of asset management and lease management. To begin, identifying the main stakeholders for asset management, the lessee is the party who pays for the use of the asset or property under a lease arrangement. The lessor is the entity that receives payments from the lessee in exchange for the use of an asset or property owned by the lessor.

On the other hand, the ownership of the assets is transferred to the lessee at the conclusion of the lease period under a finance lease arrangement. However, under an operating lease arrangement, the lessor retains ownership of the property throughout and after the lease period.

To calculate depreciation using the straight-line method, subtract the asset’s salvage value (what you anticipate it will be worth at the end of its useful life) from its cost. The result is the depreciable basis or the amount that may be depreciated. Subtract this amount from the number of years the item will be usable.

Dynamics 365 FinOps provides streamlined asset management to achieve maximum efficiency and readiness for enterprises to attain their full potential.

Key Benefits of Asset Leasing in Dynamics 365 FinOps

Lease Calculation Automation

It automates the complex lease current value calculation and related processes, including prospective lease payment, lease liability amortization, right-of-use asset depreciation, and cost schedules.

Automated Classification

The lease is impromptu categorized as either operating or financial and a temporary or low-value lease. The lease classification tests include the transfer of ownership, purchase option, lease length, present value, and unique asset.

Centralized Maintenance

The maintenance of lease information is centralized, including significant dates such as the lease’s start and end dates, the transaction currencies, payment amounts, and payment frequency.

Generation of Accounting Entries

It aids in the initial recognition and subsequent measurement of the lease obligation and right-of-use asset by generating accounting entries.

Automated Calculations and Adjustment Operations

Reduces the amount of time it takes to calculate complicated lease modification and automatic adjustment operations

Multi-level Publishing

Provides publishing to various levels to meet numerous reporting needs, such as tax reports in Dynamics 365 Finance.

Balance Sheet Impact Calculator

Using the Balance sheet impact calculator conforms to accounting requirements for representing leases on a balance sheet.

Audit Controls

Provides audit controls over the lease data’s integrity to guarantee that the posted transactions match the computed amounts of current value, future payments, and liabilities amortization.

Import and Export with Management Tools

All leasing data can be imported or exported to Excel utilizing data management tools.

Assistance in Compilation

Disclosures and notes are critical components that help in the process of asset leasing reports.

Integration of Data

The company’s financial statements, currencies, fixed assets, vendors, journals, data management, and number sequences are all integrated.

Components of Asset Leasing in Dynamics 365

Microsoft Dynamics 365’s comprehensive, integrated capabilities can handle complicated contracts and multi-location fleets via automated financial and operational leasing and documentation.

Dynamics 365 helps organizations to manage their rental, leasing and servicing needs

from servicing, replacement, and invoicing to auto-sending papers to various stakeholders, third parties, and customers.

If we particularly take Asset Lease then lease details, payment schedules, starting and ending dates of the contracts, and payment frequency are all mapped out in this functionality.

- It also automates the computation of net present value, monthly lease payments, interest, and lease amortization.

- Depending on the parameters, the system runs lease categorization tests and creates lease transactions based on the framework provided by the accounting standard you’re using.

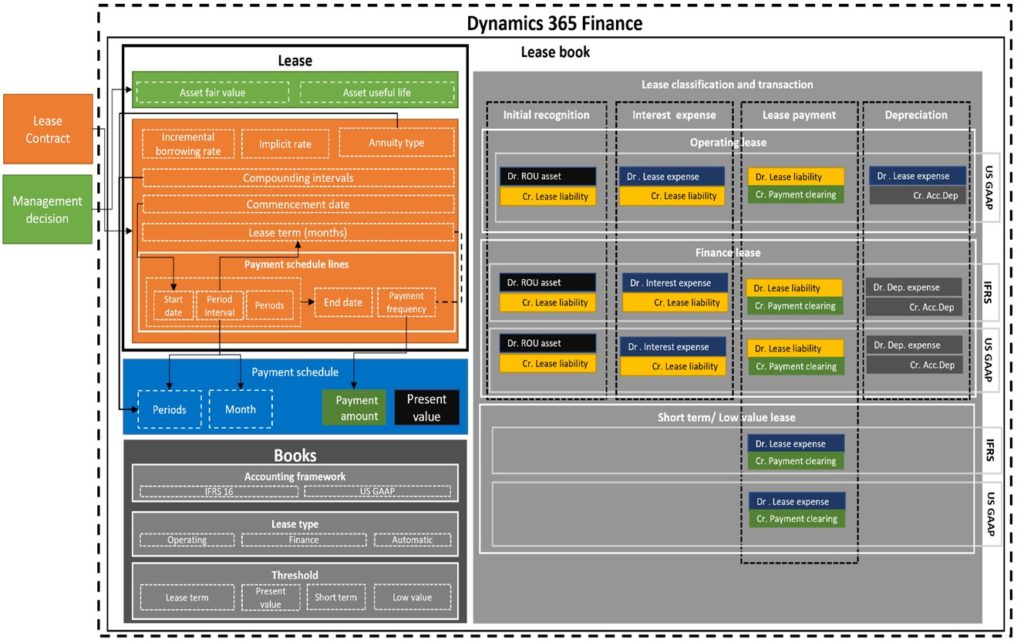

The illustration below represents the whole process, from the payment schedule to the lease classification, and the accounting activities.

A Resolve that Matters

Keeping track of your asset leases is an exhausting job, especially without an integrated system. However, all the necessary and advanced tools included in Dynamics 365 Finance and Operations are outstanding for revolutionizing lease finance while keeping your company legally compliant.

Asset leasing, particularly in the real estate and automotive industries, helps consumers feel secure since adequate accounting rules for ASC 842 and IFRS 16 get implemented entirely. It not only ensures that risks are reduced throughout, at a large scale, but at offline calculation phases.

In a word, Microsoft Dynamics 365 Finance & Operations handles everything for your organization and can help you with the efficient implementation of Asset leasing and lease management of those assets for strategic and informed growth.

With Microsoft Dynamics 365 F&O Asset Leasing, you can manage, track, and automate financial operations for leased equipment.

Before implementation, a full inspection and analysis of the operations in the context of Asset Leasing is required and you will need an experienced partner for this with a global footprint.

To Chalk Out Your Future Strategic Success

Dynamics Solution and Technology has made a reputation for itself across the world, particularly in the Gulf and Mena areas, by providing business solutions under the umbrella of Microsoft Dynamics 365. Industry-specific solutions, such as Fleet management and Property management, are extremely important in optimizing many businesses and their processes. Asset management plays a pivotal role as well.

One of the most compelling reasons to choose Dynamics Solution and Technology as your digital transformation partner, is we are a certified Microsoft Gold Partner, and our responsible business performance, with the quality-driven and unmatched value delivered.

Dynamics Solution and Technology is the one-stop solution for all your digital transformation, particularly for Asset leasing with its various elements and components, and other FinOps needs as You plan to adopt a new digital strategy. We can help you automate the system, providing timely and accurate results. We envision success for your business by paying attention to the smallest elements and providing comprehensive analysis reports.

We offer experience, in-depth information, and project governance long after your solution is live, making us the appropriate all-arounder Microsoft Gold Partner to handle your digital transformation demands with the Microsoft Dynamics 365 ecosystem.

Connect today to discuss and resolve your business challenges discursively.