Expanding your business across borders is an exhilarating prospect. It opens doors to new markets, diverse talent pools and growth opportunities. But this excitement often meets a harsh operational reality, that is, the staggering complexity of the international payroll.

Managing payments, compliance and regulations across multiple countries, currencies and legal systems can quickly become a nightmare, diverting valuable resources from strategic growth initiatives.

If you’re struggling with the intricacies of paying a global workforce, you’re not alone. From navigating ever-changing tax laws and labor regulations to handling multiple currencies and facilitating seamless cross-border payments, errors can lead to significant operational disruptions.

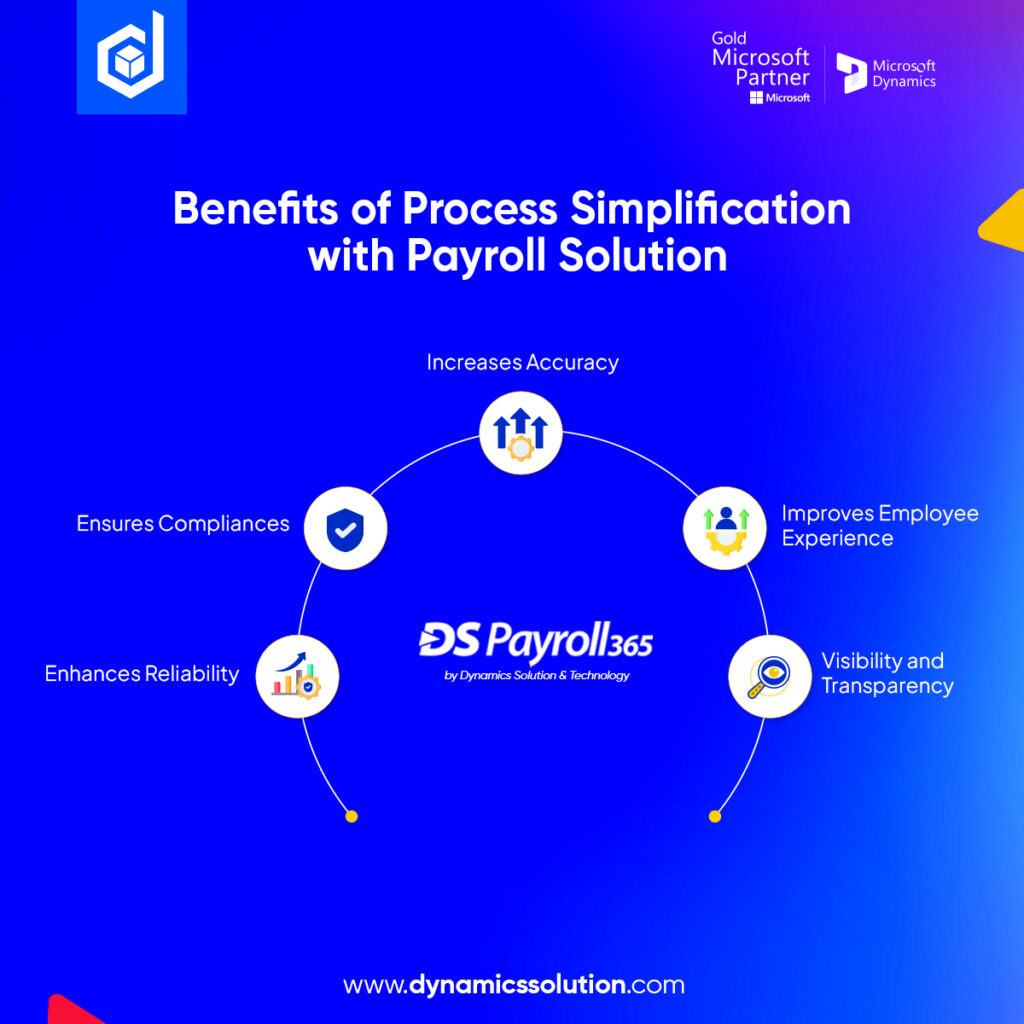

In this high-stakes environment, finding the best payroll solution is critical for sustainable international success. That is what this blog explores, a solution which is built to resolve the challenges of an international workforce. DS Payroll 365, a purpose-built HR and payroll solution has become an excellent choice for businesses operating within the Microsoft Dynamics 365 ecosystem, specifically to conquer the unique hurdles of an international workforce.

We’ll dive deep into its capabilities but let’s first understand why such a need for an advanced HR and payroll solution is there.

The Growing Need for Advanced International Payroll Solutions

As businesses expand globally, traditional payroll systems increasingly fall short of meeting complex international requirements. Companies operating across borders face a multitude of challenges that generic payroll solutions simply cannot address adequately:

- Managing payments across different time zones and currencies

- Navigating varied tax regulations and compliance requirements

- Handling different pay cycles and calculation methods

- Ensuring security of sensitive financial data across international networks

- Integrating with diverse banking systems worldwide

DS Payroll 365 was developed specifically to overcome these challenges, making it the best payroll solution for international operations in today’s interconnected business world.

Why DS Payroll 365 is the Best Payroll Solution for Global Operations

Seamless Multi-Currency Management

One of the most significant advantages of choosing DS Payroll 365 as your payroll solution is its sophisticated multi-currency functionality. The system handles currency conversion automatically, utilizing real-time exchange rates to ensure accuracy in every transaction. This eliminates the need for manual calculations and significantly reduces the risk of errors that could lead to employee dissatisfaction or compliance issues.

The platform maintains detailed records of all currency conversions, providing comprehensive audit trails that prove invaluable during financial reviews or regulatory inspections. For multinational corporations managing payroll across various countries, this feature alone can save countless hours and prevent costly mistakes.

Comprehensive Regulatory Compliance Across Regions

International payroll management involves navigating complex webs of regulations that vary significantly between countries and regions. DS Payroll 365 stands as the best payroll solution for compliance management due to its built-in regulatory frameworks for over 120 countries.

The system continuously updates its compliance database to reflect the latest tax laws, labor regulations and reporting requirements across different jurisdictions. This ensures that your business remains compliant without requiring your internal team to become experts in international payroll legislation.

Furthermore, it generates region-specific reports that satisfy local reporting requirements with minimal manual intervention. From European GDPR compliance to Asia-pacific data protection regulations and ZATCA compliance in Saudi Arabia, the system adapts to meet various standards across continents.

Borderless Payment Processing

Traditional payment methods often involve significant delays and excessive fees when processing international transactions. DS Payroll 365 revolutionizes this aspect of global payroll by offering truly borderless payment capabilities.

The system integrates with international banking networks and modern payment platforms to facilitate fast transfers regardless of geographic location. Employees receive their compensation on time whether they’re based in New York, London, Dubai or anywhere in between.

This streamlined approach to international payments not only improves employee satisfaction but also enhances cash flow management for the organization. Finance teams gain real-time visibility into global payroll operations, enabling better forecasting and resource allocation.

Multi-Region Payroll Consolidation

Managing separate payroll systems for different regions creates unnecessary complexity and increases the risk of inconsistencies. DS Payroll 365 serves as the best payroll solution for consolidation needs, providing a unified platform that standardizes processes while accommodating regional variations.

The system’s multi-region architecture allows for:

- Centralized management with localized execution

- Standardized reporting across all operational regions

- Consolidated data storage with appropriate access controls

- Uniform policy implementation with necessary regional adaptations

This balanced approach ensures consistency in payroll operations without sacrificing the flexibility needed to address unique regional requirements. Companies using this solution, report significant improvements in operational efficiency and substantial reductions in administrative overhead.

Advanced Features That Make DS Payroll 365 the Market Leader

Real-time Compliance Monitoring

It incorporates real-time access to continuously monitor international regulations and automatically implement necessary adjustments to payroll calculations. This proactive approach to compliance significantly reduces the risk of penalties and ensures that your payroll operations remain in line with evolving legal requirements.

The system flags potential compliance issues before they become problems, allowing your team to address concerns proactively rather than reactively. This predictive capability positions it as the best payroll solution for risk-conscious organizations operating across multiple jurisdictions.

Seamless Integration Capabilities

Modern businesses rely on interconnected systems to maximize efficiency and data integrity. DS Payroll 365 integrates with Dynamics 365 Finance and Operations, Business Central and also offers extensive integration capabilities with popular HRIS platforms, accounting software, time tracking tools and enterprise resource planning systems.

These integration options eliminate data silos and reduce the need for duplicate entries, minimizing the potential for errors while improving overall operational efficiency.

Enhanced Security Protocols

International payroll inherently involves the transmission of sensitive financial and personal data across borders. It implements bank-level security measures to protect this information at every stage of the payroll process.

The platform’s comprehensive security features include:

- End-to-end encryption for all data transmissions

- Multi-factor authentication for system access

- Role-based permissions to ensure appropriate data access

- Regular security audits and vulnerability assessments

- Compliance with international data protection standards

These security measures make DS Payroll 365 the best payroll solution for organizations that prioritize data protection in their global operations.

Implementation Process and Support

Transitioning to a new international payroll system can seem challenging but DS Payroll 365 offers a structured implementation process designed to minimize disruption and maximize adoption like:

- Comprehensive needs assessment and system configuration

- Data migration with thorough validation protocols

- Phased rollout starting with pilot regions

- Customized training for administrators and end-users

- Parallel processing period to ensure accuracy

Throughout implementation and beyond, clients receive dedicated support from specialists with expertise in international payroll management. This ongoing partnership approach ensures that organizations realize the full potential of this payroll solution available for their global operations.

Stay Audit-ready with Dynamics Solution and Technology

By implementing DS Payroll 365 by Dynamics Solution and Technology, your organization can reduce administrative burdens and provide a consistent experience for employees worldwide. As the global business environment continues to evolve, having the best payroll solution in place will be increasingly crucial for maintaining competitive advantage and operational excellence.

Contact Dynamics Solution and technology today to discover how our international payroll solution can transform your global payment operations and support your business’ continued growth across borders.