To simplify the whole system related to tax, zakat, and customs by enhancing the legislative transition to eliminate departmental and governance system redundancy, as well as to promote maximum ease for residents, businesses, and enterprises operating in KSA.

This article will provide readers with an explanation of what ZATCA is about and how it came to its inception, what taxpayers should know now, and how businesses can prepare for the second phase, commonly referred to as the integration phase. Furthermore, some general information regarding business requirements when it comes to ZATCA especially tax in the Kingdom of Saudi Arabia is provided.

The Saudi Cabinet authorised the merger of the General Authority of Zakat and Tax (GAZT) with the General Authority of Customs on May 4, 2021, to become the ‘Zakat, Tax and Customs Authority’ (ZTCA).

By offering high-quality services, the Authority commits to collecting customs duties, Zakat, and tax and achieving the highest degree of taxpayer compliance by the most promising methodologies.

This move was part of Saudi attempts to reorganize government institutions in order to speed up the implementation of the Vision 2030 national reform plan.

What exactly is E-invoicing (Fatoorah)?

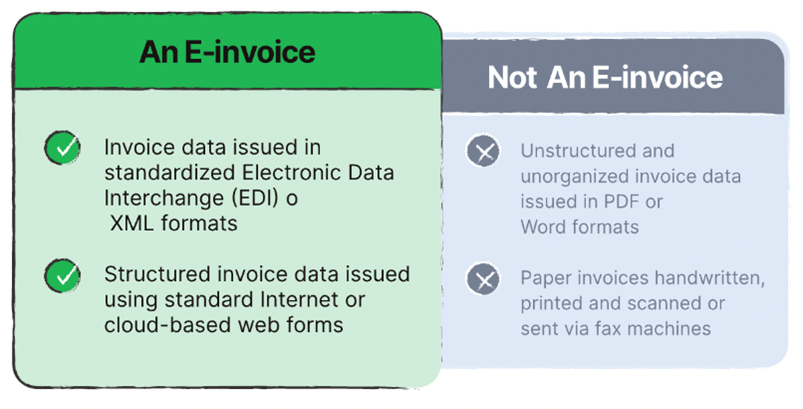

E-invoicing is the process of creating electronic invoices in order to issue and keep them electronically. ZATCA – The Zakat, Tax, and Customs Authority is implementing the first phase of e-invoicing in the Kingdom of Saudi Arabia, requiring firms to use it by December 4, 2021. With e-invoicing, it will be easier to handle invoices, credit notes, and debit notes in a structured electronic format between seller and buyer.

Key steps of ZATCA e- Invoicing in KSA; Know Your Procedure

- Create ZATCA compliant E-Invoice

- Add Customers and Products

- Cloud Based

- Manage and track e-invoices, Delivery Notes, and Payments

- Manage e-invoices against Delivery Notes

- Manage invoices against performa invoices

- Allow customers to pay invoices via SADAD

- Credit and Debit notes

In Synopsis

The Zakat, Tax and Customs Authority (‘ZATCA’) provided more details on the introduction of the second phase of Electronic Invoicing (E-Invoicing in KSA) for its citizens and business owners on June 24, 2022.

According to the declaration, the first group would comprise taxpayers with revenues greater than SAR 3 billion in the calendar year 2021.

In due time, ZATCA will notify the first set of selected taxpayers who will be required to implement the essential requirements in order to link their billing system with ZATCA’s.

In Profundity!

The E-Invoicing regime is a byproduct and example of Kingdom of Saudi Arabia’s economic rebirth and digital transformation, and it is a continuation of a success story that began with the first phase of E-Invoicing implementation.

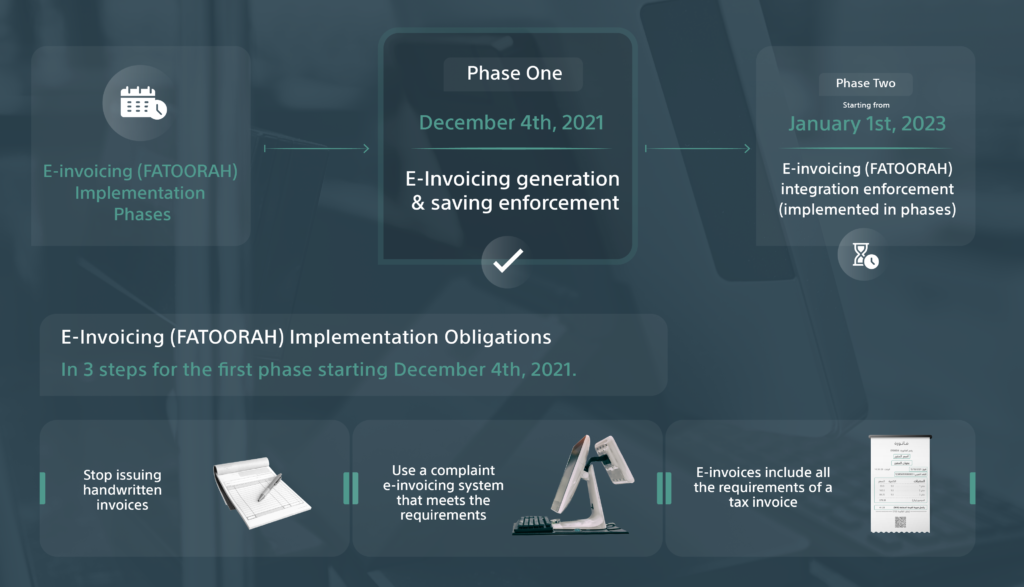

ZATCA has implemented e-invoicing in KSA in two stages:

Generation phase – went active for all taxpayers on December 4, 2021.

The first set of selected taxpayers will go live on January 1, 2023, during the integration phase.

The integration phase of E-Invoicing in KSA includes certain extra needs from the generating phase, the most notable of which are: Connecting taxpayer billing systems to the ZATCA system

Issuing E-Invoices in a specific format that includes a number of additional elements in the E-Invoice XML file (such as UUID, hash, cryptographic stamp, and so on) that will be rolled out as part of the integration phase, as well as some other elements that will be visible on the printed copy of the E-Invoice.

ZATCA has said that the integration phase would be conducted gradually and in groups and that all following groups will be notified at least six months before the date scheduled for connecting their systems with ZATCA’s.

To explore more about the changes proposed by ZATCA, you must be always informed.

What You Should also Acknowledge;

People must comprehend the essential difference between an e-invoice and a non-e-invoice, according to ZATCA rules in KSA.

During this phase, firms must meet the following criterion:

In order to transmit invoices to ZATCA’s site for verification and validation, integrate your e-invoicing solution with their system.

Invoices should be sent in certain forms, such as XML or PDF/A-3 with integrated XML.

Have a system that conforms with ZATCA’s technical criteria standards.

What taxpayers should know and how to prepare? Know Your Procedure

Your system should be able to communicate with external systems via APIs and generate a UUID (Universally Unique Identifier), digital signature, a unique sequential number for each invoice, and a cryptographic stamp.

You will be expected to exchange data and report bills to ZATCA for validation and verification throughout this period.

As per reports, the ZATCA has also said that first-wave taxpayers will be fined if they are not completely compliant by July 1, 2023. It does not rule out the possibility that the penalties for noncompliance will still apply as of January 1, 2023, as specified in the VAT Act in KSA.

As a result, taxpayers should comply with the e-invoicing integration phase requirements based on the ZATCA notifications and begin the process of analyzing and deploying the necessary adjustments to the IT and business landscape.

Guidelines for ZATCA Approved (Fatoorah) E-invoicing in KSA

The most significant modifications to the e-invoicing Implementation Resolution, include relevant annexures, such as data dictionary, XML implementation, and security feature implementation standards.

To simplify the entire governance system by enhancing the legislative transition to eliminate departmental and governance system redundancies, when it comes to tax, zakat, and custom streamlining.

Furthermore, to promote maximum ease for residents, businesses, and enterprises operating in KSA, different Documents (procedural documents regarding tax, zakat, and customs allow ZATCA to authorize an e-invoice in KSA. According to the ZATCA Laws, there are the following ZATCA mandatory fields;

- CSID; Cryptographic Standards ID and QR code process.

- Tax Invoice and Simplified tax e-invoices

- Debit and Credit notes

- 3 XML These all are stored electronically.

What impact does promptly compliant E-INVOICING IN KSA have?

Based on the notification issued by the ZATCA, resident businesses and citizens must comply with these Phase-Two rules by opting for prompt e-invoicing in KSA and taking the appropriate procedural steps in order to make the necessary improvements in their corporate operations.

Dynamics Solution and Technology is Strategic about Ambition ‘KSA Vision 2030’

We are professionals in E-Invoicing and Digital Reporting at Dynamics Solution and Technology. We can assist you in making sense of the rapidly changing reporting landscape in Saudi Arabia and across the globe.

Furthermore, Dynamics Solution and Technology, which is well-versed in global markets and diverse sectors, is working to deploy solution regarding e-invoicing in KSA based on Microsoft Dynamics 365 F&O and business central solution. In the past few years, Dynamics Solution and Technology satisfied many of our clients who went live with Phase One e-invoicing in KSA .

Contact an expert like Trent to see how we can simplify reporting for your company.