In today’s hyperconnected digital landscape, businesses are constantly seeking ways to stand out in the crowd, retain customers, and drive revenue growth. During such competitive times, businesses are increasingly moving to Microsoft Dynamics 365 and beginning to invest in customer engagement to yield a multitude of advantages for financial organizations. Ranging from heightened operational efficiency, expanded revenue prospects, and an amplified customer lifetime value, the growth of Customer Engagement Platforms (CEPs) exhibits a greater propensity to unlock the hidden potential in the financial domain of business expansion.

Microsoft Dynamics 365 offers comprehensive collaborative tools that allow integration with the customer engagement platform. This directly translates into:

- Enhanced Regulatory Compliance

- Improved Risk Management

- Customer Feedback Insights

- Improved Decision-making

- Promising Data Security

- Operational Efficiency

This blog addresses these challenges and discusses the proactive steps to enhance their customer engagement strategies and put an end to the financial struggles.

Navigating through the Customer Journey

Financial institutions cultivate an intricate understanding of the customer journey to proficiently engage customers. The customer journey emphasizes the customer’s overall perception of your brand as they move from being a prospect to becoming a paying customer, rather than solely focusing on the quantity of sales generated. Every interaction, spanning from the initial point of contact to the post-purchase support phase, is construed to be an integral constituent of customer engagement.

One of the most potent features of customer engagement platforms is its ability to collect, consolidate, and analyze vast amounts of customer data. For instance:

- 360-degree view of the customer’s financial history

- Segmenting and targeting according to financial behavior

- Personalized financial planning and advisory services.

- Consistent and accessible multi-channel engagement

Nevertheless, the integration of Microsoft Teams and opportunity deal teams/customer cases – allows focused, traceable, and instant collaboration across multiple business areas on key opportunities and client issues.

Leveraging this capability allows organizations to capture new data points, implement workflows, and define new business rules and processes within a flexible framework, thereby supporting financial innovation rather than stifling it.

Leveraging a Diverse Marketing Approach

The strategic deployment of diverse marketing channels can cause a substantial increase in customer engagement levels. Through coordinated actions across a wide range of platforms, businesses can significantly boost brand awareness, enhance effectiveness, accurately reach specific customer groups, and diligently comply with regulatory requirements.

LinkedIn, for instance, holds a prominent position and offers an excellent platform for engaging with business-oriented individuals. Compared to other social channels, 82% of B2B marketers obtain their greatest success with LinkedIn.

Nevertheless, trust and compliance hold utmost importance, in the realm of financial industries. Leveraging multiple channels for transparent communication can help establish trust with customers while ensuring compliance with regulatory requirements. A comprehensive multi-channel marketing strategy can provide a competitive edge in the financial services arena. Given that many of your competitors are likely utilizing these channels, maintaining an active presence across them can help you stand out.

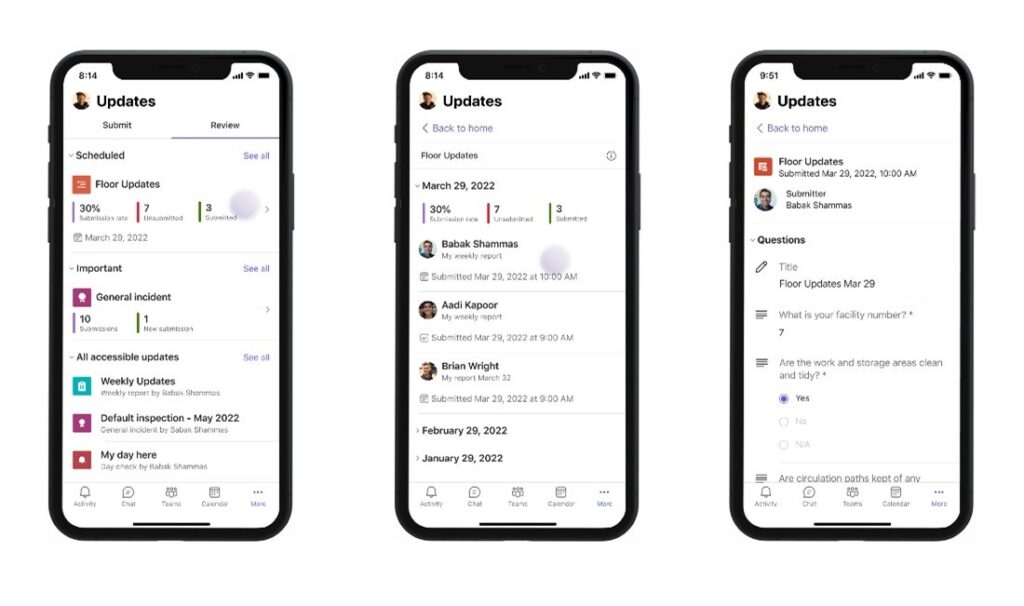

Embrace a Mobile-First Engagement Strategy

The increasing popularity of fintech providers is reshaping customer expectations within the financial services industry. In response, financial service organizations have turned towards the adoption of a mobile-centric approach to customer engagement, placing mobile platforms at the forefront of their strategic endeavors. In the realm of mobile engagement, successful financial service providers are implementing strategies such as in-app messaging and mobile wallets, thereby affording clients a superlative mobile experience and endowing them with useful tools for the seamless management of their financial affairs, irrespective of their geographical location.

A global study, encompassing 2000 corporations, conducted by IDC reveals that an overwhelming 80% of financial services enterprises currently employ or planning to deploy integrated mobility-channel solutions for the facilitation of interactions with both clients and personnel.

In all, by embracing a mobile-focused engagement strategy, financial service companies can elevate customer engagement, foster brand loyalty, and drive business growth.

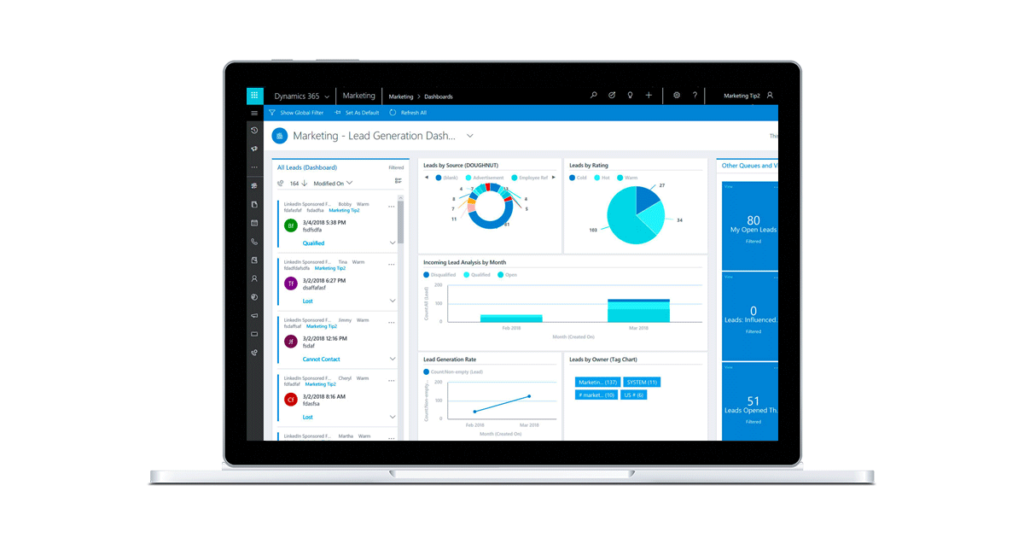

Microsoft Dynamics 365: Single Solution for Your CRM Needs

For organizations grappling with challenges and experiencing difficulties in their financial performance, it is imperative to recognize that these struggles may indeed stem from a deficiency in effective customer engagement practices.

Failure to prioritize and invest in a customer engagement platform can result in diminished customer retention, reduced customer loyalty, and missed revenue growth opportunities. Therefore, it is necessary to navigate the multifaceted demands of the financial sector, optimizing customer engagement while ensuring regulatory compliance and operational efficiency.

Dynamics Solution and Technology | Tailored Support and Expertise

Microsoft Dynamics 365 suite remains a complete and holistic solution for all your financial business needs. From monitoring your global financial operations in real-time, predicting outcomes, and making data-driven decisions that drive business agility and growth, it is the one for you.

Dynamics Solution and Technology has helped its clients open new horizons of development for organizations with a global footprint. Infusing the strengths of the Microsoft Dynamics 365 suite into the business framework, our expertise helps to add proficiency and accuracy via tailored support and customizations.

At Dynamics Solutions and Technology, we help you develop a customized customer engagement solution that, in the long run, is more cost-effective and beneficial to a dynamic business.

Implementing a single, comprehensive, customer-centric platform is just a click away. Contact now!