The Zakat, Tax, and Customs Authority (ZATCA) in Saudi Arabia has introduced a transformative initiative—the mandatory adoption of e-invoicing. This move aligns with the global trend towards digital transformation in financial and tax processes. For businesses operating in Saudi Arabia, understanding and complying with these new requirements is crucial. E-invoicing not only ensures compliance but also enhances operational efficiency, transparency, and accuracy in financial reporting.

E-invoicing is a digital system where invoices are generated, exchanged, and stored electronically. This system replaces traditional paper-based invoicing methods, thereby reducing errors and increasing efficiency. By transitioning to e-invoicing, businesses in Saudi Arabia can streamline their invoicing processes, ensure faster payments, and improve overall financial management.

Understanding the Phases of E-Invoicing Implementation

Phase 1: Overview of Initial Implementation Requirements

The e-invoicing initiative is being implemented in stages to allow businesses ample time to adapt. Phase 1, also known as the “Generation Phase,” was launched on December 4, 2021. During this phase, businesses were required to generate and store e-invoices in a structured electronic format.

Phase 1 required businesses to use compliant software solutions for generating e-invoices. These solutions had to meet specific technical requirements set by ZATCA, including the ability to generate invoices in XML or PDF/A-3 formats, include a QR code, and ensure data integrity. This phase focused on preparing businesses for the full-scale implementation of e-invoicing by familiarizing them with the necessary technologies and processes.

Phase 2: Key Changes and Enhancements Introduced

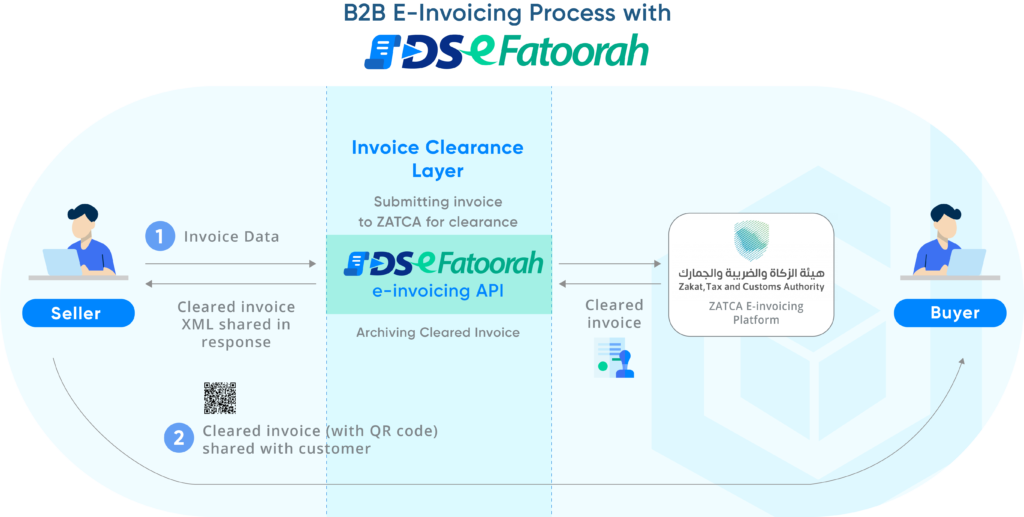

Phase 2, or the “Integration Phase,” commenced on January 1, 2023. This phase introduced more stringent requirements, including the integration of e-invoicing systems with ZATCA’s platform. Businesses are now required to submit e-invoices and related documents in real-time to ZATCA.

In Phase 2, businesses must ensure their e-invoicing systems can connect with ZATCA’s central platform. This involves real-time transmission of invoice data to ZATCA for validation and approval before the invoices can be shared with customers. The integration phase also mandates enhanced security measures to protect sensitive financial data from unauthorized access and ensure the authenticity of electronic invoices.

Future Phases: Potential Developments and Their Implications

While the details of future phases are yet to be fully outlined, it is anticipated that ZATCA will continue to refine and enhance the e-invoicing process. Potential developments may include further automation of tax reporting, advanced analytics for compliance monitoring, and integration with other financial systems to create a seamless end-to-end digital tax ecosystem. Businesses should stay informed about these developments to ensure ongoing compliance and leverage the benefits of advanced e-invoicing technologies.

Future phases may also involve the implementation of machine learning and artificial intelligence (AI) to predict and prevent fraudulent activities, analyze spending patterns, and optimize tax reporting.

Key Fields and Business Process Changes

Explanation of Essential Fields and Data Requirements in E-Invoices

To comply with ZATCA’s e-invoicing requirements, businesses must ensure that their e-invoices contain specific fields and data elements. These include the supplier’s and buyer’s details, a unique invoice number, invoice date, and a breakdown of goods or services provided. Additionally, each e-invoice must include a QR code that facilitates the quick verification of invoice details.

E-invoices must also contain the VAT registration numbers of both the supplier and the buyer, the total amount before and after VAT, and the applicable VAT rate. The inclusion of these fields ensures that all necessary information is captured for accurate tax reporting and auditing purposes.

How Businesses Can Adapt Their Existing Processes to Comply with ZATCA Guidelines

Adapting to these requirements necessitates changes to existing business processes. Businesses should invest in e-invoicing software that supports the mandatory fields and data elements. Training staff to understand and implement these changes is also crucial. Moreover, integrating the e-invoicing system with existing ERP or accounting software can streamline operations, ensuring that invoices are generated, validated, and submitted to ZATCA efficiently.

Businesses should conduct a thorough assessment of their current invoicing processes and identify any gaps that need to be addressed. Implementing an e-invoicing solution that offers real-time data validation, automated invoice generation, and seamless integration with existing financial systems can significantly improve compliance and operational efficiency. Regular audits and process reviews can help in maintaining compliance and identifying areas for improvement.

ZATCA Requirements: Detailed Steps and Best Practices for Ensuring Seamless Compliance

Ensuring seamless compliance with ZATCA’s e-invoicing requirements involves several key steps:

- Evaluate current invoicing and accounting systems to identify gaps in compliance.

- Choose and implement an e-invoicing solution that meets ZATCA’s technical specifications.

- Train employees on the new e-invoicing processes and compliance requirements.

- Regularly validate data to ensure accuracy and completeness of e-invoices.

- Test the integration between the e-invoicing system and ZATCA’s platform to ensure smooth data transmission.

- Continuously monitor the e-invoicing process to identify and resolve any issues promptly.

Additionally, businesses should establish clear communication channels with ZATCA to stay updated on any changes in regulations or technical requirements. Regular feedback sessions with staff can help in addressing any operational challenges and improving the overall e-invoicing process.

Common Challenges Faced by Businesses and How to Overcome Them

Businesses may encounter several challenges during the transition to e-invoicing, including technical issues, data inaccuracies, and resistance to change. Overcoming these challenges requires a proactive approach:

- Technical Support: Engage with e-invoicing solution providers for technical support and troubleshooting.

- Data Management: Implement robust data management practices to ensure the accuracy of invoice data.

- Change Management: Develop a change management strategy that includes clear communication, training, and support for employees.

To address resistance to change, businesses can highlight the benefits of e-invoicing, such as improved efficiency, cost savings, and enhanced compliance. Involving employees in the transition process and providing adequate training can help in easing the shift to digital invoicing.

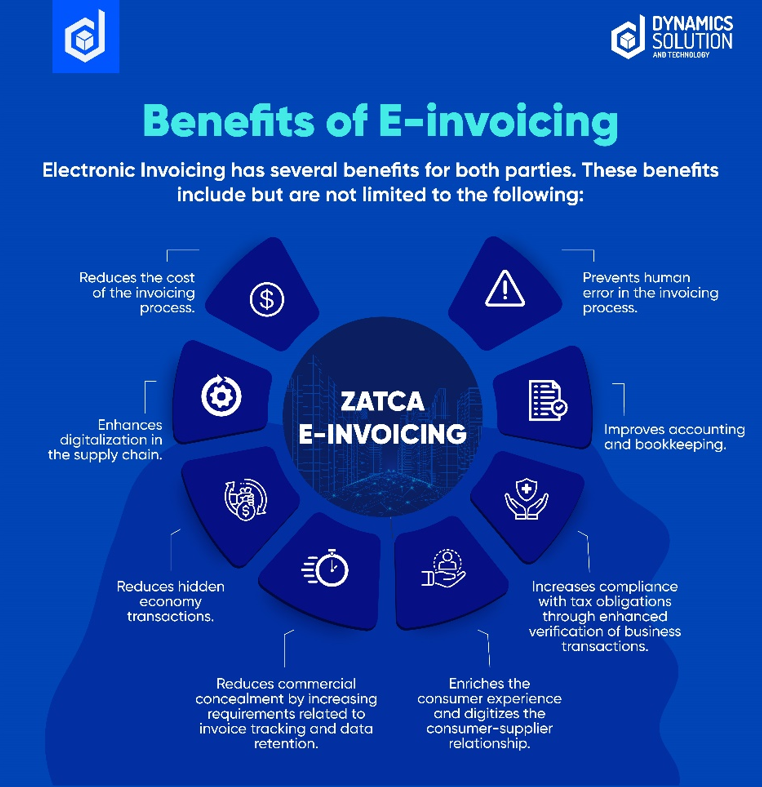

Benefits of E-Invoicing Adoption

E-invoicing significantly improves the efficiency of invoicing and financial processes. By automating invoice generation, validation, and submission, businesses can reduce manual efforts, minimize errors, and accelerate payment cycles. This leads to better cash flow management and financial stability.

Automated e-invoicing systems can also handle large volumes of invoices simultaneously, reducing processing times and enabling businesses to focus on core activities.

Cost Savings and Reduced Paperwork

Digital invoices are easier to store, search, and retrieve, reducing administrative overhead and enhancing document management.

It also reduces the risk of loss or damage, ensuring that records are easily accessible for audits and financial reviews. The reduction in paper usage contributes to environmental sustainability, aligning with corporate social responsibility goals.

Enhanced Transparency and Auditability

E-invoicing enhances transparency and auditability by providing a clear, digital trail of all transactions. This transparency simplifies the auditing process, reduces the risk of fraud, and ensures compliance with regulatory requirements.

The use of secure digital signatures and encryption ensures the authenticity and confidentiality of e-invoices. This level of security is crucial for maintaining trust and confidence in digital financial transactions.

Potential Advancements and Innovations in E-Invoicing Technology

The future of e-invoicing technology holds exciting possibilities. Innovations such as Artificial Intelligence (AI) and blockchain are expected to enhance the accuracy, security, and efficiency of e-invoicing processes. AI can automate complex tasks like data extraction and validation, while blockchain can provide immutable records of transactions, further enhancing transparency.

In addition, the development of interoperable e-invoicing systems that can communicate seamlessly across different platforms and jurisdictions will facilitate global trade and compliance. Businesses should stay abreast of these technological advancements to leverage new opportunities and maintain a competitive edge.

Global Trends Influencing E-Invoicing Practices in Saudi Arabia

Global trends in e-invoicing, such as interoperability standards and cross-border e-invoicing frameworks, will likely influence practices in Saudi Arabia. Businesses should stay informed about these trends to leverage new opportunities and remain competitive in the global market.

As more countries adopt e-invoicing regulations, international businesses will benefit from standardized processes and reduced compliance costs. Staying updated on global e-invoicing trends can help businesses in Saudi Arabia anticipate changes and adapt their strategies accordingly.

DS eFatoorah-a Taxpayer-Supported E-Invoicing Solution

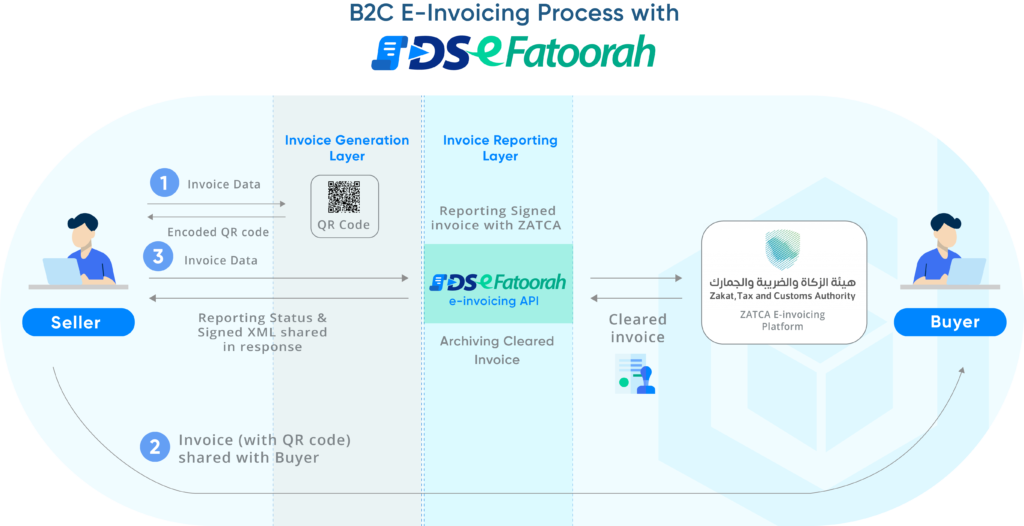

As e-invoicing technology continues to evolve, staying ahead of regulatory changes and leveraging innovative solutions will be key to maintaining compliance and driving business growth. DS eFatoorah is a taxpayer-supported e-invoicing solution according to GAZT rules and regulations. Our entirely automated cloud-based ZATCA-compliant process ensures successful e-invoice generation. Here’s how we integrate your ERP with the ZATCA system:

Our solution ensures easy future archiving of invoices, accessible with a few clicks—save you time and effort in managing your invoicing records. Reach us out here to get it implemented and saving yourself from hefty penalties!