In the perplexing and dynamic landscape of the market, businesses of any scale must be adaptive and flexible to embrace changes. Because of their scalability and scope, the operations are complex for large organizations, but small and mid-size businesses also face issues due to their limited resources, workforce, and market demand. According to McKinsey and Company, the employees and workforce in SMBs account for two-thirds of the total employment in the business sector in advanced countries. Managing their operations is a challenge whether it is scheduling work, or affairs like job hunting, finances, and payroll.

Payroll is central to organizations as well as the employees because, by the end of the day, it is the capital in your bank account that matters most. Small businesses invest 5% manpower and approximately 120 working days on administrative tasks including payroll. But even then, the payroll issues and complexities sustain and become one of the reasons that employees start looking for a new job. Just two payroll errors and 50 percent of the salaried employees will start looking for a new job.

Automation and integration are the best ways to streamline payroll processes and complexities. They allow you to inculcate and foster intelligence to get accurate and seamless processing and results of the complex payroll. Investing in a good payroll solution can bring the desired turnout to ace your goals and organization.

Dive into the intricacies of this blog to explore the process simplification for payroll and how an end-to-end managed payroll solution can get you a competitive edge.

Major Friction-Points in Payroll Processing

Complexities in conventional payroll processes are the biggest worry in administrative operations. Before discussing the issues, let us have a brief insight into payroll processes. Payroll is the process of administering compensations and benefits to your employees while considering the legal and regulatory compliances. Starting from counting working hours, paid time-out, and unpaid leaves to calculate wages, to withholding taxes, and benefits, and ensuring timely payment of wages, there is an extensive workflow in payroll calculation.

All these tasks are crucial as well and prone to errors. A minor mistake can result in wrong calculations, which affects your organization’s reputation and leads to employee dissatisfaction. Moreover, keeping manual records and going back and forth due to decentralized data indicates inadequate record keeping, increasing process inefficiencies, and ultimately wasting time as well as resources.

Therefore, it is important to simplify payroll procedures and streamline your workflow to avoid and overcome or at least minimize these challenges and get the most of your time and resources (whether they are related to capital or workforce). Many organizations opt for outsourcing their payroll processes, but this also brings risks of its kind because you are entrusting a third party with sensitive and critical information about your company and employees. The next section explores what you can do to simplify your payroll processes and what are the best choices you can make to enjoy error-less payroll.

Effortless Simplification of Payroll Operations

Simplifying the payroll process can save you a lot of hustle and frustration. The centralization of data and integrating related departments can ease workflow. Here is how you can also do it.

Workflow Automation

Replacing manual records and paperwork with software or a centralized solution that is end-to-end managed and encompassing intelligence can save you time and resources. By implementing such a solution, the routine tasks are streamlined and done while reducing the administrative workload. This enhances the accuracy rate, reducing the instances where your employees might leave the job due to payroll inaccuracies.

Standardizing Payroll Schedule

Only automating your payroll processes would not be favorable because the uncertainty about the next paycheck will be persistent. In the current economic crisis and increasing inflation, a lot of people live paycheck to paycheck with no other source of income. Standardizing and setting a consistent whether it is weekly, biweekly, monthly, or any other makes it easier to predict the upcoming salary check which allows both the organization and employee to plan and implement the resources and budget accordingly, by standardizing and automating, you can reduce payroll errors and make your procedures more consistent and reliable.

Regulatory and Legal Compliances

Payroll compliance is pivotal to ensure legal and regulatory compliance. Streamlining these regulations can protect you from any legal actions that may occur if not complied with. Once the pay schedule and all the compensations and benefits are determined, tax deduction and filing at the organization’s end are equally important. Staying up to date with recent laws and regulations, streamlining taxes, and seamless but accurate deductions from salary, all help you to avoid huge fines and penalties.

Employee Self-Service

Tracking hours, managing leaves and absentees, and having an insight into the compensation and benefits are equally important for employees as they are for an organization. Confiding these tasks to employees can help build trust, increase reliability, and streamline administrative tasks that enhance workplace efficiency to drive organizational success and growth. Such an employee self-service portal allows employees to monitor their working hours, paid time off, and the benefits they are eligible for. Fostering employee autonomy optimizes your resources by addressing inefficiencies that might occur in payroll otherwise, getting sustainable growth-based results.

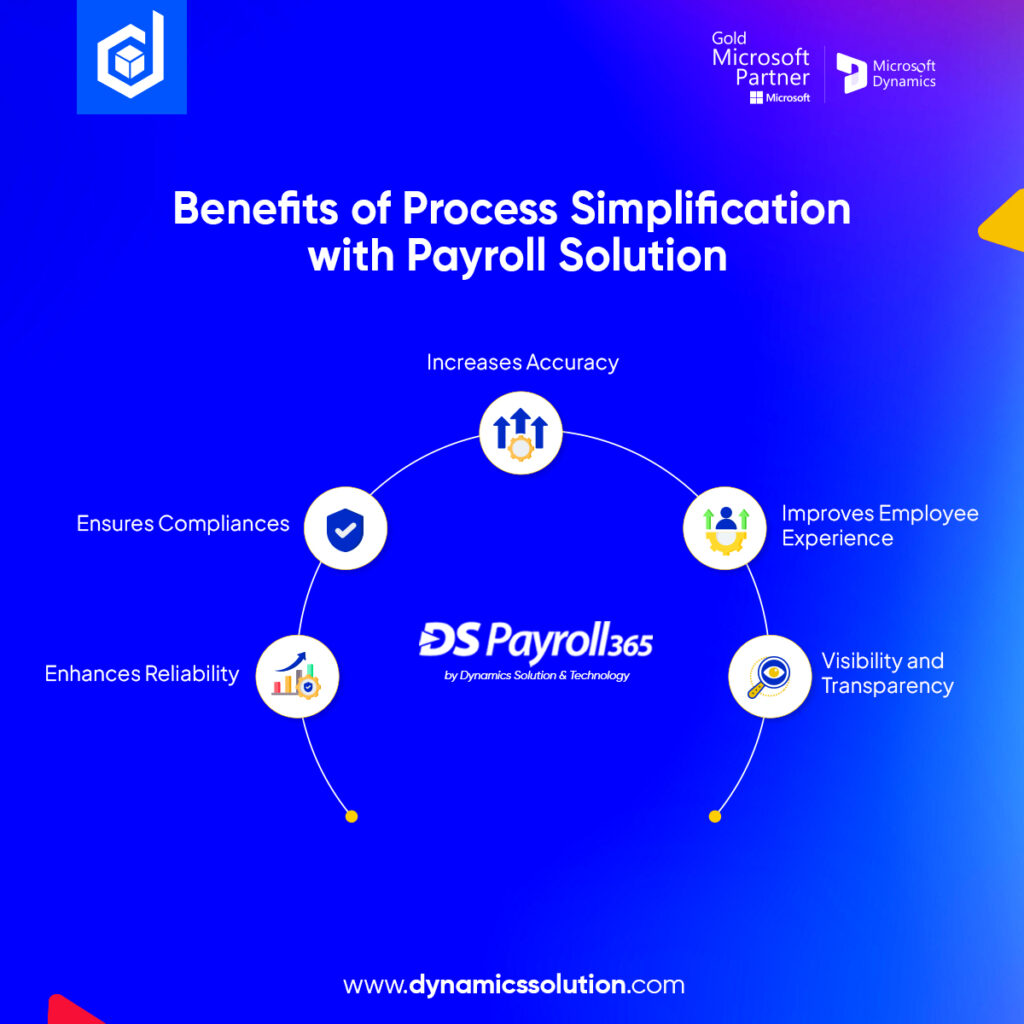

Unlocking Payroll Efficiency with Dynamics Solution and Technology

Payroll automation is the key to simplifying these operations, and you can achieve it by implementing an integrated, centralized, and intelligent solution that can improve overall efficiency and speed up your payroll processes. With a plethora of available options, DS Payroll 365 for F&O and Business Central is a cutting-edge solution that combines all the operations on a single platform, especially your payrolls. From payroll reporting to calculation, processing, timesheets, compensation assignments, and compliance, everything can be done with a single solution to give a data-driven experience, which leverages the potential to support all payroll operations.

So far, we have figured out the challenges in the payroll process, how to simplify them, and why DS Payroll 365 serves as the best choice for your organization, but one aspect is still missing, and that is the implementation partner. If partnering with the best is your choice, then Dynamics Solution and Technology is best suited for you. As a Gold and Solution Partner of Microsoft, Dynamics Solution and Technology tailors state-of-the-art solutions that fit your payroll requirements. We have been streamlining payroll and HR operations for organizations globally including the Gulf, Mena region, and European countries.

Are you still confused? Note your concerns and book a demo to talk with our expert here. Start enjoying hustle and error-free payroll operations today.