What is an Electronic

Invoice (FATOORAH)?

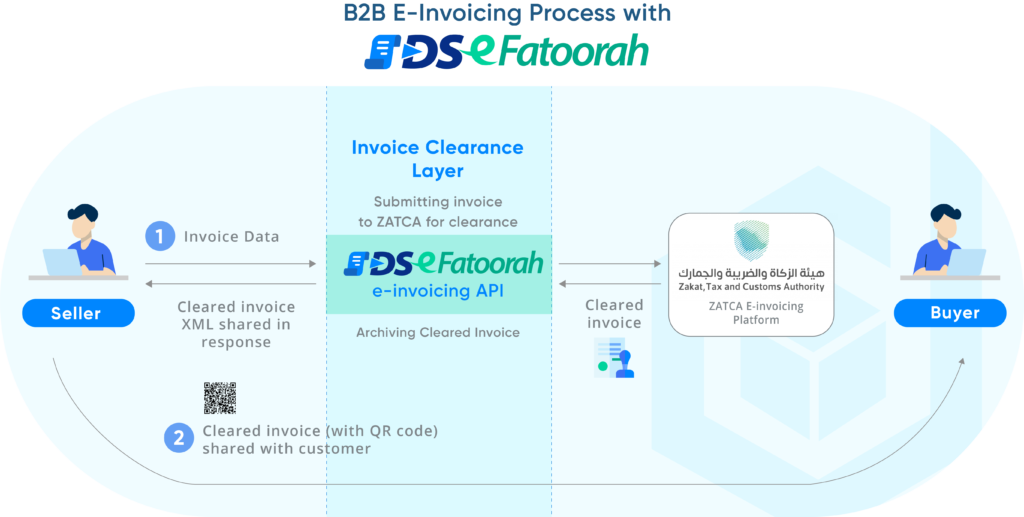

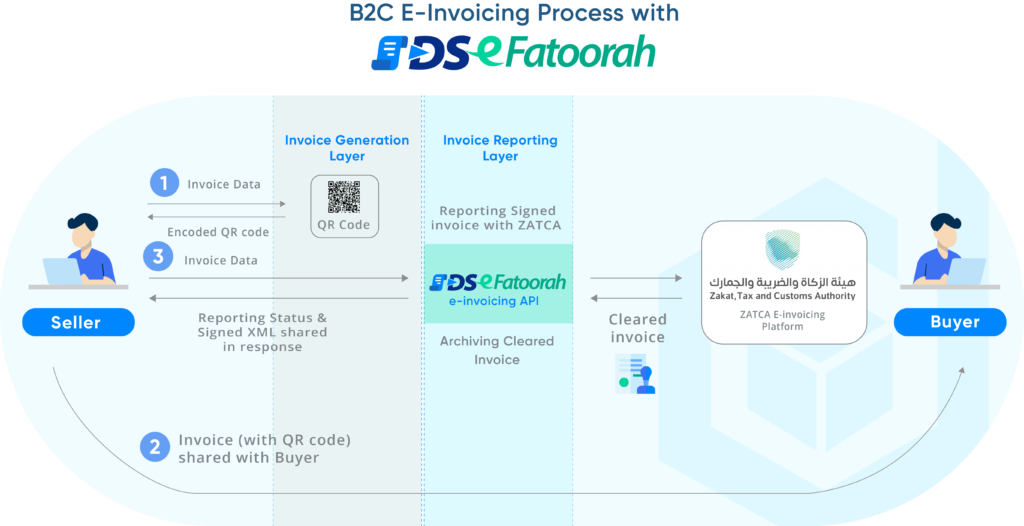

E-invoicing revamps the handling of invoices, credit notes, and debit notes by introducing electronic formats and replacing traditional paper processes. In Saudi Arabia, the implementation occurs in two phases. Phase 1 mandates the electronic generation and storage of invoices, eliminating manual creation. Phase 2 necessitates integration with ZATCA E Invoicing Solution for real-time validation of invoice data. E-invoicing drives digital transformation in tax administration, granting tax authorities comprehensive visibility and enabling data-driven review and prefilled VAT returns.

Why is E-invoicing being

Introduced in KSA?

As part of the Saudi government’s efforts to digitize the economy and encourage e-invoicing, initiatives like ZATCA have been introduced. E-invoicing offers several benefits, including reducing administrative tasks for businesses, enhancing compliance, and fostering transparency.

Furthermore, e-invoicing enables the government to effectively monitor companies and their operations. It facilitates the creation of a centralized database that can be utilized for audits. With easily accessible information, tax authorities can minimize the frequency of audits compared to traditional methods.