You’re the captain of your business financial ship. It’s in your hands either to let your business ship sink or to enjoy the journey by docking it perfectly. This means you need to ensure that your every puzzle is solved correctly, without breaking it into parts.

In a business language, you must have a know-how of the process and categories involved at every step—from delivery fees to service charges.

For this reason, we have curated a technical blog to help you know the Charges in Dynamics 365 Finance and Operations.

Types of Charges

The following are the very common types of charges:

- Delivery charges or transport charges

- Service

- Packing charges

- Carries charges, Labor

- Insurance charges

- Repair Charges

Treatment of Charges

Based on the different business cases, we can segregate the charges into 2 categories:

Inventory charges (Added to the cost of inventory)

- Paid to

- Paid to the third party (very common case)

Expenses (Not added to the cost of inventory)

- Paid to

- Paid to the third party (very common case)

Following will be the accounting treatment for the charges:

Charges added to inventory (Paid to vendor)

The following will be the final entry during the invoice.

Inventory Dr

A/P (vendor account) Cr

Example:

Let’s say you have a PO of 1000 USD, and the vendor says, I will ship the goods and will charge 20 USD for the delivery charges.

So, the entry will be,

Material Acc 1000 + 20 = 1020 DR

A/p (vendor Account) 1000+ 20 = 1020 Cr

Charges added to inventory (Paid to third party)

This is the most common case and can become complex based on the client’s requirements.

Example:

Let’s say you are buying something from Ali Baba, and they send you the goods with the help of a third party, that is the shipment company. Ali baba says you will pay the shipment or delivery charges to the shipment company.

In that case:

Inventory Acc Dr 1020

VendorAccCr1000

Third party Cr 20

Expenses (not added to the Inventory paid to the vendor)

The vendor is shipping the goods, and some charges are added that are not value addition to the Inventory cost in that case you will not add those charges to the inventory cost.

InventoryAccDR1000

Expense Acc DR 20

Vendor Acc 1020

Expenses (not added to the Inventory paid to the third Party)

Let say vendor is shipping the Goods and some insurance charges are added by the shipper and that we need to pay to the Insurance company.

InventoryAccDR1000

Acc DR 20

Vendor Acc CR 1000

Insurance Expense Acc CR 20

Setup:

Charges added to inventory (Paid to third party)

- Click on

- Add the Code name &

- Select the “Item” on the debit

- Select the “Ledger, Posting type & Account” on the credit

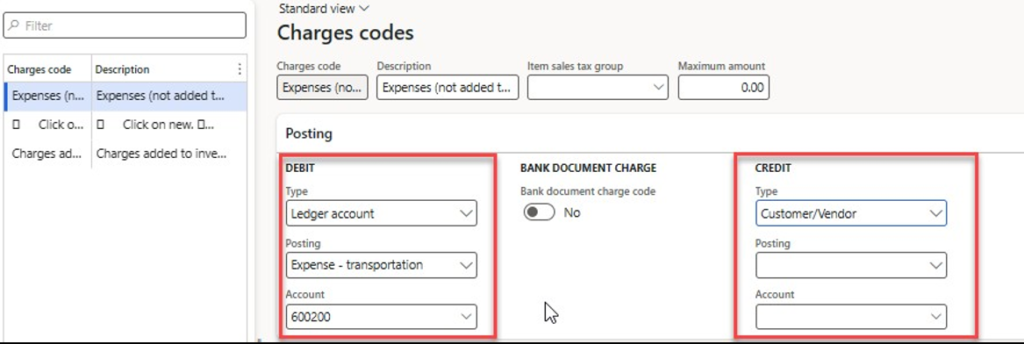

Expenses (not added to the Inventory paid to the vendor)

- Click on

- Add the Code name &

- Select the “ledger, Posting type& Account” on debit

- Select the “Vendor” on the credit

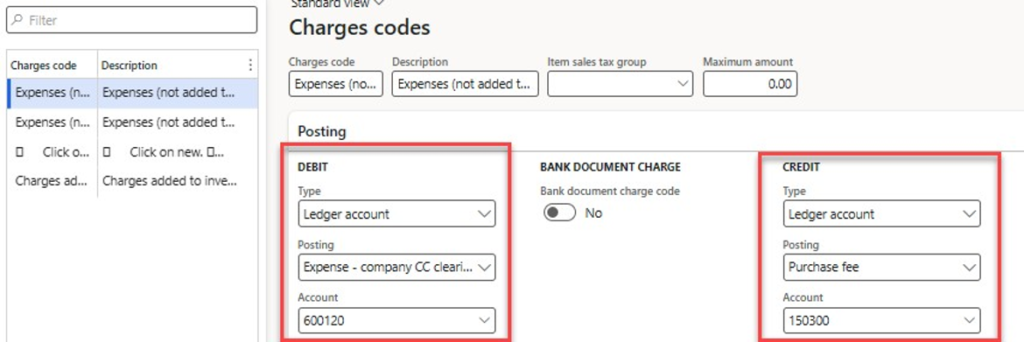

Expenses (not added to the Inventory paid to the third party)

- Click on

- Add the Code name &

- Select the “ledger, Posting type& Account” on debit

- Select the “Vendor” on the credit

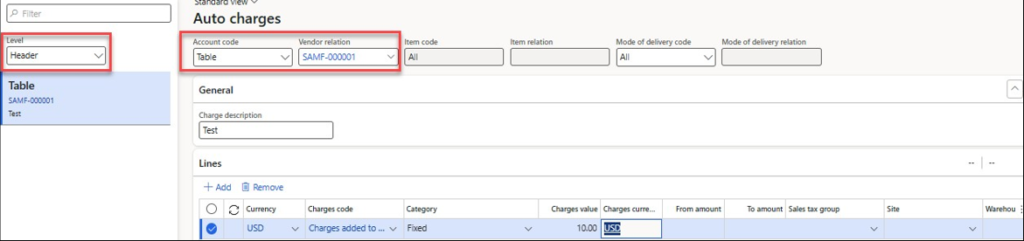

If you want to set up the auto charges on the header & line level, you do setup based on the different combinations in the auto charges setup.

Wrap Up

Embrace this powerful ally, and let it guide you towards smoother seas and brighter horizons in your financial endeavors. If you feel a need to make your finances stack up accurately, reach out to Dynamics Solution and Technology.

We can help you achieve greater accuracy, efficiency, and control in your financial operations today.