Businesses all over the world confront procedural challenges when it comes to managing their finances, including operational structure, cost management, real-time reporting, and accurate analytics. Other obstacles include making transparent budget decisions based on forecasts and effectively managing account inflows, high costs, and corporate risks. In these scenarios, an effective financial solution is necessitated to rescue the corporate interests of any enterprise.

Dynamics 365 FO, powered by a cutting-edge technological platform, provides flexible scalability, fast deployment, and ease of administration. This considerably reduces customers’ total cost of ownership and provides a class-leading return on investment (ROI).

Furthermore, a strong yet modern ERP system such as Microsoft Dynamics 365 for Finance and Operations, which comprises three major components, is now making rounds globally, easing pathways for businesses. Microsoft Dynamics 365 finance and operations, Microsoft Dynamics 365 Supply Chain Management, and Dynamics 365 Project Operations are all seamlessly integrated with a variety of Microsoft solutions, including Office 365, SharePoint, and others. Companies that actively employ Microsoft corporate solutions benefit from a comprehensive and adaptable infrastructure that enables them to establish efficient cooperation and an ideal business organization as a whole.

Total Economic Impact Research

According to Forrester Consulting, enterprise resource planning (ERP) technologies are entering a new era. According to this viewpoint, ERPs have become increasingly experience-driven in order to represent their vital position in digital business, and are distinguished by agility and AI-driven processes. Forrester refers to this new generation of ERP software as digital operations platforms (DOP).

We are delighted to share the findings of a recently commissioned Total Economic ImpactTM (TEI) research done by Forrester Consulting on behalf of Microsoft in the context of DOPs.

The Blog highlights the possible return on investment (ROI) that businesses might receive by implementing Microsoft Dynamics 365 Finance and operations.

Strategy and Objective

Forrester’s TEI research is a methodology designed to help businesses navigate the complexity of acquiring technological solutions. The Total Economic Impact (TEI) research also assists technology suppliers in objectively analyzing and conveying the value proposition of their technologies. To that aim, the TEI research presented here provides a methodology for company decision-makers to evaluate the possible financial effect of installing Dynamics 365 Finance.

Finally, the 2022 study’s financial effect is an estimate for a composite company built by Forrester based on real-world interviews with four organizations that currently are utilizing Dynamics 365 finance and operations. The experiences of these corporate entities, as well as the findings of the interviews, are combined to form a composite company.

The composite company for this research is a retail and wholesale firm with 50 retail sites, 100 wholesale clients, 2,000 workers, 120 finance team members, and $750 million in yearly sales. Continue reading to discover the study’s initial results and the significant difficulties confronting the composite organization.

Important challenges

Several key issues were shared by the companies questioned for the TEI research, including:

- Legacy solutions that require a lot of upkeep!

- Significant solution customization.

- There is a lack of standardization in financial procedures.

- Manual procedures and cultural knowledge are used.

- Inadequate real-time visibility.

Finally, these difficulties prompted the composite company to seek out and invest in a solution that could:

- Provide standard basic financial and accounting processes.

- Give finance teams real-time visibility.

- Allow the company to scale in response to current business needs.

Key Findings

Organizations can use Dynamics 365 Finance to overcome the restrictions of substantially customized legacy ERP platforms. Subsequently, it relieves financial experts of the burden of laborious and time-consuming operations. At the same time, it gives enterprises access to real-time data and platform flexibility that earlier solutions lacked, helping them to keep up with the pace of digital commerce.

The Forrester analysis identified three quantitative effect areas: increased productivity of finance team members increased productivity of IT workers and legacy cost reductions. Let’s take a closer look at each of these areas to discover how Dynamics 365 Finance adds value to business finance.

As we have seen here, Forrester’s TEI study uncovered three primary quantifiable impact areas and several soft benefits. Taken together, the study found that dynamics 365 finance and operations delivered a total economic impact of $3.41 million in financial savings over three years. The total investment required was $2.8 million and provided an ROI of 122 percent.

Microsoft Dynamics 365

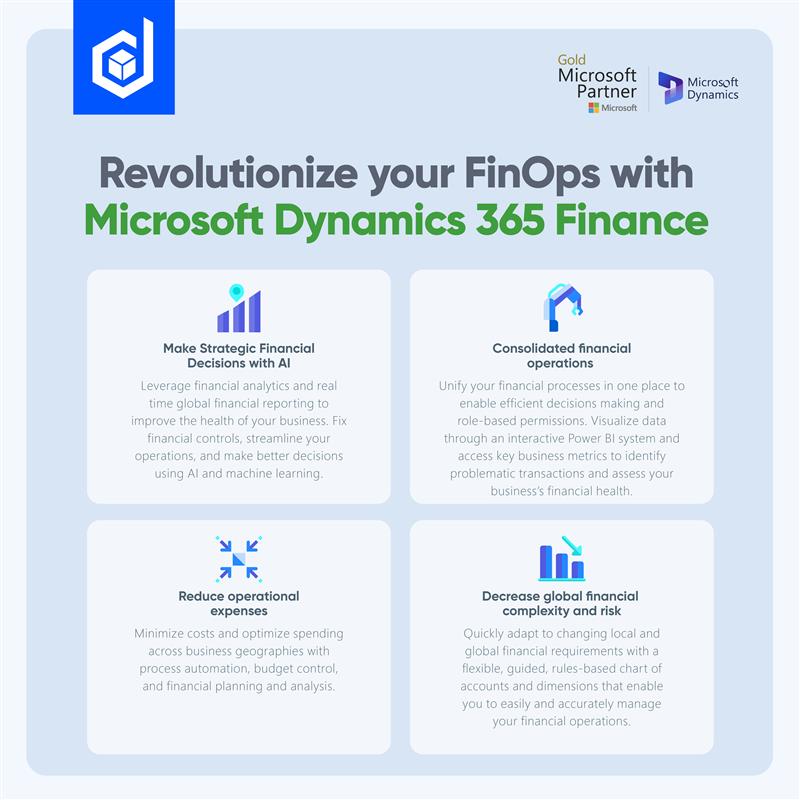

Cloud-based business apps represent the newest generation of intelligent software. The entirety of Microsoft Dynamics 365 FinOps’ architecture was created in the cloud and can be installed on-premises, which not only makes it safe and secure but also makes it simpler.

Overall Key Advantages

Aside from the measurable benefits listed above, the firms questioned for the TEI research discovered additional advantages, such as:

- Real-time visibility and data, resulting in better decision-making and agility.

- Enhanced regulatory compliance

- Improved system availability.

- Connection to the Microsoft ecosystem.

- Better living quality for a financial personnel.

Increased financial staff productivity

Interviewees described how, prior to installing Dynamics 365 Finance, legacy ERP actively limited the business by necessitating manual report development and delivery. As a result, financial operations required additional personnel to support them, and once reports were sent, the information was frequently outdated. Furthermore, process standardization was very difficult because these firms had vastly varying procedures and systems based on area, location, and kind of site (retail, office, and more).

Deploying Dynamics 365 Finance and operations enabled enterprises to standardize and streamline financial procedures across locations. Simultaneously, by employing real-time information and automation, finance teams might repurpose some team members to support higher-value-added tasks while avoiding adding more staff through external hiring.

The three-year present value of productivity gains in finance employees was $2.30 million.6

Enhancements to IT staff productivity

Similarly, when firms transitioned from traditional, on-premises ERP solutions to the cloud-based ERP architecture of Dynamics 365 Finance, IT staff productivity improved. Most legacy solutions had been in place for more than a decade, posing a number of issues. The ERP solutions, in particular, had been increasingly customized over time, necessitating large personnel to operate and maintain functioning. This situation was made more difficult by the fact that team members who had experience and understanding of the numerous adaptations have gone on to other jobs or companies. Further adaptations were more complex and time-consuming due to the absence of consistency.

By installing a system that provided better capability with fewer adaptations and was easier to manage overall, the composite company significantly decreased IT administrator and development hours.

The current value of IT staff productivity increases over three years was $402,870.

To dig deeper into the results and to better understand what Dynamics 365 Finance can do for your business, check out our blog covering comprehensive yet discursive information on implementation methods of Dynamics 365 ERP diverse solutions regarding Forrester Senior Consultant Richard Cavallaro and Principal Analyst Leslie Joseph. You can also download and read the full study: The Total Economic Impact™ of Microsoft Dynamics 365 finance and operations

Sum it Up

Dynamics 365 Finance solution easily adapts to changes in both local and global financial requirements, reduces corporate risks, and satisfies all the needs required for the financial departments of large and medium-sized enterprises to work effectively, thanks to the flexible, pre-configured chart of accounts and analytical dimensions. Centralized financial reporting in real-time for one or several legal entities and currencies makes it possible to improve financial flow management, optimize cash flow, and monitor the implementation of budgetary obligations in detail.

Scale Globally with Dynamics Solution and Technology

Dynamics Solution and Technology has made a reputation for itself across the world, particularly in the Gulf and Mena areas, by providing business solutions under the umbrella of Microsoft Dynamics 365.

With industry-specific solutions like managing financial operations, our exceptional track record of successful deployments using the Microsoft Dynamics 365 suite is worth noticing.

Our seasoned specialists delve deeply into the core of your business’s processes and principles while working to develop a strategy that is customized to your requirements. Our specialty is deploying, upgrading, and integrating Microsoft Dynamics 365 Finance and Operations, Business Central, AX & NAV, and CRM to create an enchanting impact.

Dynamics Solution and Technology believes in long-term relationships and is here to assist you in planning and implementing your Enterprise Resource Planning (ERP) Software. Please, contact us if you’d like to learn more.