Automation, once considered a luxury for large corporations, is now accessible and indispensable for businesses of any size. A report by McKinsey & Company found that automation has the potential to increase global productivity growth by 0.8% to 1.4% annually. As businesses set out to reap the growing benefits of automation, the financial sector is already ahead of the game.

Gartner defines financial automation as:

“Finance automation technology integrates machine learning and artificial intelligence for use in areas such as financial analysis, payroll administration, invoice automation, collections action, and preparing financial statements. The use of such automated software reduces the need for human intervention in these activities.”

Automating financial processes has long been a goal in business, and today it’s essential if you want to keep up with the competition – but just what is it that makes it so invaluable?

Financial Automation for Exponential Business Growth

The C-level financial experts have constantly felt extra pressure to deliver striking results while overcoming financial hurdles. Global inflation, supply chain disruptions, market volatility, and recession fears are a constant driving force that trims costs and boosts efficiency. Nevertheless, it is equally important for them to provide better customer and employee experiences.

As a result, every company and organization must now strive to do more with the tools and resources at their disposal. A survey of Global 500 companies found that leaders choosing to invest in AI and automation business tools and software solutions expect to see significant growth within the next few years.

Financial automation has created major advancements in the field, prompting a dynamic shift from manual tasks to critical analysis being performed. This shift from data management to data analytics has created significant value for businesses.

Saves Time

Finance teams are widely known for getting themselves exhausted by the tedious and time-consuming tasks of managing financial books. With an end-to-end financial automation tool, they no longer have to fear running into a bottleneck that can possibly cause delays and other business problems.

Reduce Errors

Automation software prevents the otherwise manual errors that would take place. Humans are prone to make mistakes. However, with an automation tool, the possibility of making mistakes and financial errors will be significantly reduced, adding speed to data processing, and adding accuracy.

Increase Compliance

Finance departments have strict rules and regulations to abide by. These guidelines are established by the company handbooks and are audited on a regular basis to ensure the finances remain streamlined. In addition to this, businesses also have to follow the regulations as listed by the governments and also the international standard, if they are operating beyond the geographical borders.

Since remembering all these regulations and their updates is not possible, the financial teams are prone to make mistakes. However, financial automation tools allow users to quickly tweak, halt, or redesign a financial process to ensure adherence to regulations.

Improve Employee Satisfaction

Employees need to get into the nitty gritty financial details as they manually locate, retrieve, format, and transform data for use. Along the process, it is natural for financial experts to feel overworked.

Over the next two years, 64% of business professionals at enterprise organizations plan to build automations that focus on improving the employee experience. Leveraging the use of robotic process automation for financial use, employees can focus their attention on other more important aspects of the business while dedicated bots work their way through the financial redundancies.

Quick Deployment

Businesses commonly struggle with the onboarding of a new automation tool. There continue to be instances when the new tool cannot be integrated with the legacy system, and it requires a lot of work to do so. With financial automation tools, businesses can seamlessly integrate with legacy systems without any fear of risking any data.

Access to Data

Since the automation tools run on the cloud, they provide all users with immediate access to data. The users can access any data at any time for anything that is required. Also, the heightened security updates and faster disaster recovery possibilities with cloud infrastructure relieve you from unnecessary costs.

Enhanced Security

Financial data comprises sensitive information about the clients that must be protected from any malware. These financial automation tools come with enhanced security levels to manage data encryption, reducing the risk of hacks or security threats.

For financial firms, top areas of investment include security AI, automation, and incident response (IR). In 2023, 39% of financial organizations reported “extensive use” of security AI and automation, which led to $850,000 in savings compared to the global average cost of a breach.

Continuous Process Improvement

Every business landscape needs to continuously improve itself. Financial automation streamlines it by utilizing reports and dashboards to keep track of your KPIs and analytics in real time.

Business Intelligence

Financial data constitutes complex datasets. Visually it is difficult to digest and make use of it for any decision. With financial automation tools, the real-time dashboards quickly transform raw data into visual insights.

According to a Statista survey carried out in 2023, 46%of the respondents indicated improved customer experience thanks to AI.

In all, the latitudinal benefits of financial automation tools focus on driving efficiency, reducing errors, and unlocking growth opportunities.

Infusing AI with Financial Automation Tools

In recent times, the outbreak of artificial intelligence and Copilot has swept across the global industry, and given birth to fascinating innovations, that too, without any need for extensive coding knowledge.

Microsoft Power Platform: Your Ally in Financial Operations

AI is infused in the large language models that drive Microsoft’s Power Platform. The monthly active users of Power Platform are a staggering 33 million, as they announced on Microsoft Build 2023. They are bound to grow with the inclusion of Microsoft 365 Copilot which leverages AI to provide financial forecasting, risk assessment, and investment optimization services. By analyzing financial data to identify patterns and trends, these solutions offer valuable insights for finance professionals, helping them make informed decisions and improve financial performance.

The convergence of AI, Copilot, and Power Platform opens new exploration avenues for business users to build workflow automation, apps, pages, and bots with little to no coding language.

Scalable Development

Financial users can integrate their Power Apps with Copilot, allowing users to import Excel files in the Power Apps Studio. Here the Copilot processes the data and transfers it to the Dataverse environment. The scalable feature of Copilot allows users to determine column headings and data types, simplifying the financial app creation process. The resulting app is fully functional, allowing users to browse, search, create new records, and customize the app effortlessly.

Automated Workflows

The AI and Copilot experience across the Power Platform generates customizable experiences and suggests improvements to enhance workflows and applications. In the realm of finance, it completely transforms invoice processing. Copilot allows users to build and automate basic workflows using natural language prompts, eliminating the need for extensive coding expertise.

Moreover, finance teams also require document processing capabilities to extract data as they process any financial document. Embedding the AI builder with Copilot allows for extracting invoice details, extracting approval justifications, and generating comprehensive emails. Incorporating the use of technologies like machine learning and OCR to auto-extract, validate, and enrich documents. This further streamlines the process, saves costs, and improves efficiency.

Data Visualization

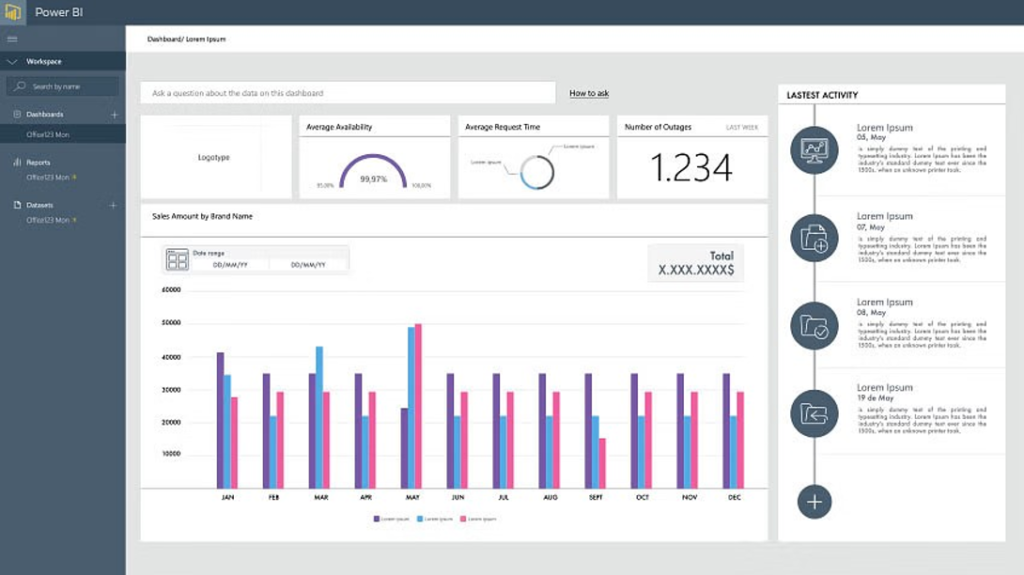

Financial experts no longer have to worry about complex data queries. With Copilot, you can describe the visuals and insights you need in human language, and it will create powerful Power BI dashboard summaries, and answer your questions. This directly helps with streamlining sales, operation planning, automating financial consolidation, and making the book-closing process seamless.

The collective, strategized dashboard budgets and forecasts effortlessly, ensuring your business strategy stays on track. In all, AI-Powered Predictions give a comprehensive view of your workforce, and cash flow dynamics, and tap into highly accurate predictions through advanced predictive analytics powered by machine learning and AI.

Robotic Process Automation (RPA)

Many everyday business tasks, like processing data or producing reports, are standardized and repetitive – what used to be called “paper-pushing”. Such tasks are boring for humans – and also take up human resources that are better used elsewhere.

RPA solves this by creating dedicated software “agents” that perform the same task again and again as needed, engaging with applications and data as a human would – but with the process automated and not needing human supervision.

Process Mining

A functioning business is the sum of its processes—all the tasks people perform every day and how they interact. Improving the business functionalities include undergoing improvements to analyse these processes (process mapping) and make them perform better.

While improving business functionalities is a difficult task, process mapping is helpful for small businesses. Process Mining works by “looking at” a company’s data flows and how they produce a result (such as how a purchase order leads to a payment approval), identifying the data interactions and transformations that represent each process.

This gives a “process map” that can be used as a tool for business improvement.

Chatbots and Conversational Agents

In finance, conversational agents can be used as virtual assistants for finance teams, or they can help automate communication between finance teams, suppliers, and customers. This reduces the employee’s engagement with repetitive questions, saving them time and allowing them to focus on other tasks.

What are the Main Challenges for Finance Automation?

Although the benefits of automating finance processes are numerous, businesses can still face many challenges along the way. For instance:

- Finance operations are the backbone of the business; therefore, companies are often reluctant to make changes in their finance business processes.

- Implementing any changes in this area could meet with powerful resistance and distrust from employees with a strong preference for the status quo.

- Regulatory challenges have to be overcome.

- Risk issues have to be taken into consideration.

- Integration of actual and plan/forecast data

- Collaboration and communication

- Facing organizational inertia

However, with the implementation of financial automation tools in your business infrastructure you can reap the benefits of automating your finance processes practically immediately.

Supercharge Your Productivity with Automation | Dynamics Solution and Technology

With revolutionary financial automation tools, businesses are already set to transform their finance departments and garner incredibly valuable data in the process. Since the positive outcomes of automation are enormous, the financial team may become overwhelmed with the amount of change they will witness during financial automation.

Dynamics Solution and Technology, a Microsoft Gold Partner, is a renowned implementation partner for businesses looking for digital business transformation. Even if it is their first time undergoing process automation or some upgrade, they are a trusted name in this arena.

Their dedicated team of implementation experts will break down your automation journey into 5 steps:

- Assess: Take a deep dive into your current processes.

- Identify: Find areas where automation can make a difference.

- Set Goals: Clearly define what you want to achieve.

- Choose Tools: Select the right automation tools for your needs.

- Implement: Roll out automation gradually and effectively.

Their innovative finance automation tools from Microsoft’s suite can easily be integrated with your existing financial software and IT systems. You won’t have to make any significant changes to your processes and workflows and can quickly:

- Scale your business easily

- Grow trust in what you do

- Expand your most impactful departments

With our expertise, you can increase your level of automation without taking the risk of altering the trusted systems that you currently have in place. In addition, you will not be confronted with huge capital outlays and a burdensome and long-drawn-out implementation process.

So, what’s stopping you from embracing financial automation? Contact us and get started!