Are you a construction business owner, struggling to tackle the financial impact of cost overruns and delays on your business? Well, you are not alone! Labor shortages and increasing wage costs have been affecting the construction industry for several years. In fact, following the effects of the pandemic, the broader global economic pressures have surged.

As a result, the construction businesses face many challenges in the ever-evolving and turbulent economic times. Known for its complex and demanding nature, it is full of numerous stakeholders, intricate processes, and significant financial investments. In recent times, cost overruns and delays have become an industry-wide status quo in construction projects.

The inclusion of smart financial management solutions plays a pivotal part in ensuring that the projects are completed within the set timeframe and budget. Nevertheless, the revenue of the global construction industry is expected to grow steadily over the next years. In 2030, it is projected to be more than twice as big as it was in 2020. The size of the construction market amounted to 6.4 trillion U.S. dollars in 2020, and it is expected to reach 14.4 trillion in 2030.

To help you keep overruns at a minimum, here are some common factors in construction projects to be mindful of to keep your project within budget.

Budget Overruns

Construction businesses have to deal with budget intricacies as they tackle material price fluctuations and scope changes. The surge in inflation rates has directly impacted the core construction materials like lumber and steel. In addition to the rising costs of these essential materials, skilled labor is significantly expensive.

Generally, contractors are tempted to use lower-quality materials to overcome the surging cost factors that can directly affect the quality of the company’s reputation in the long run. It creates a direct challenge in winning new contracts and losing potential business opportunities.

In numerous instances, construction businesses even require additional allocation of budget to complete the project. Such budget overruns lead to interest expenses and disputes amongst the clients, often ending in an unfortunate legal battle that is both expensive and time-consuming.

Inaccurate Project Estimates

Winning a construction project deal is a big win. While many of the project’s stakeholders are eager to begin with the project construction, it is important to pay diligence to the preconstruction phase that explores the definition, scope, and various components of how it will progress.

- Accurate cost estimation

- Effective project planning

- Legal compliance

- Procurement processes

- Health and safety considerations

- Environmental sustainability

- Collaborative communication among stakeholders

- Scaled-down construction prototype

Failure to inaccurately estimate the project will directly lead to budgetary issues, design revisions, and material unavailability. Adjustments made at the last minute result in cost and estimation errors, taking a direct toll on the success of the project. The rushed decisions, use of subpar materials, and inadequate safety measures will affect future business opportunities.

Hampering Cash Flows

One of the most pressing challenges for the construction industry is the careful examination of cash flow management. The delayed payments, uneven revenue streams, and extended project timelines tend to disrupt the inflow and outflow of funds, leading to financial instability.

The cycle of financial payments faces uncertainties when customers take time to make payments and your business will have to make payments to your vendors. Delayed invoices mean your time to get paid will get extensive and will have to wait longer to receive the payment from the clients. During this time, the construction industry, being a labor-intensive business, will have to pay employees on a weekly or bi-weekly basis.

To address these financial challenges in the construction business, it is necessary to adopt proactive strategies and implement effective financial management practices. Microsoft Dynamics 365 for Finance is a singular, end-to-end solution to mitigate financial risks and enhance the overall financial performance of construction projects. By implementing sound financial management practices, you can improve your cash flow, reduce project risks, and enhance profitability.

Microsoft Dynamics 365 for Finance: Debugging the Financial Errors

The systematic elimination of cost overruns bolsters the ability of construction businesses to execute complex projects with greater control. Microsoft Dynamics 365 Finance offers a comprehensive solution that not only supports basic accounting functions but also helps businesses on their journey of Digital Transformation with a profound impact on your business performance.

The actionable intelligence and business insights of D365 Finance propel your business forward.

Robust & Flexible Financials

D365 for Finance is completely GAP, FASB, and DCAA compliant and the continuous upgrades make it capable of supporting your business with new changes.

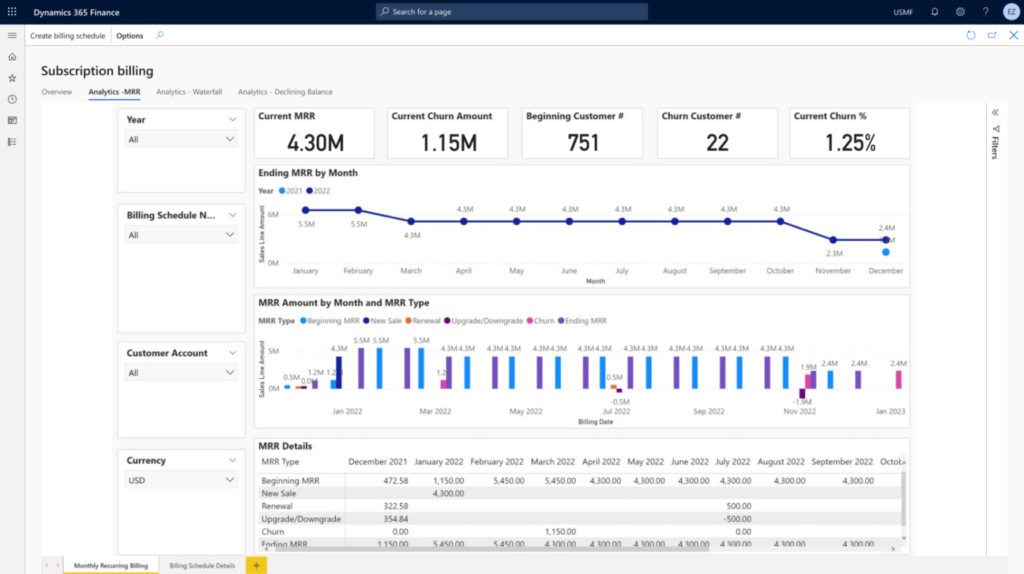

Robust Construction Accounting

Sophisticated budgeting, forecasting, and visual analytics on your dashboard give a holistic view of how the processes are moving toward completion. It also allows the project managers, in conjunction with the estimators, to generate and update estimates as required to produce more precise costs and create accurate project budgets.

Equipment Management

Effectively place and utilize high-cost equipment across multiple projects to maximize equipment ROI.

Material Management & Fabrication

Manage all your materials and procurement processes in the warehouse and in your mobile field service trucks. D365 for finance allows construction managers to easily import and manage fabrication needs in real-time, with complete project visibility of committed and actual costs.

Sophisticated Scheduling

D365 for finance offers a user-friendly and powerful service and project-based dispatch board to a full-featured Microsoft Project that’s integrated into the overall system.

Easy-to-use out-of-the-box portals

D365 Finance also integrates with other tools, allowing you to communicate with your clients and streamline interactions with your business. For instance, Microsoft Teams enables project managers to efficiently collaborate and communicate with all team members involved in their projects. With the click of a button, you can switch from group chat to video call, safely connect, view, transfer, and co-author files in real time.

Dynamics Solution and Technology | A Success-metric for Project Completion

The construction projects are sufficiently large and complex and require a significant amount of administrative and accounting challenges. Simply tracking the progress of financial spending is a complex task, that can easily be simplified with the adoption of Microsoft Dynamics 365 for Finance, allowing managers to:

- adapt to the specifics of the construction market (payment terms, low margins, lack of regular income)

- be aware of internal and external challenges for your project management, like growing costs of construction materials

- spend a lot of time on the estimation process while at the same time being flexible about possible changes in the project’s execution

Microsoft Dynamics 365 Finance brings immense improvement to financial experts. Yet, it is incomplete without the promising implementation capabilities of Dynamics Solution and Technology.

Being a Microsoft Gold Partner, Dynamics Solution and Technology has a team of experts that conduct an introductory analysis of the client’s business and craft a tailored solution with a step-by-step implementation plan. This adds ease to the data migration process, reducing the chances of data loss or corruption as the business undergoes digital business transformation.

Do you want to upgrade your business and win the infrastructure-heavy, capital-intensive, or public utility-related project? Contact our team and get started with Microsoft Dynamics 365 for Finance.