B2B business is an evolving landscape, and businesses face a multitude of challenges, each with the potential to impact their bottom line. Yet, amidst the complexity, one pain point emerges as a critical factor for success: cash flow management. As enterprises navigate the modern landscape, the traditional invoicing methods of past times can create obstacles that hinder growth and profitability. To tackle this problem, ZATCA E invoicing system provides an advanced solution.

Gone are the days of painstaking manual processes and costly errors plaguing invoicing systems. By embracing the technical excellence of e-invoicing, businesses can unleash a wave of transformative benefits that revolutionize their financial landscape.

In today’s blog, we will delve deep into the ZATCA E invoicing solution and learn its full potential of it.

Discover the Importance of E-Invoicing (FATOORAH) in Modern Business!

E-invoicing has gained prominence, driven by the introduction of the Zakat, Tax, and Customs Authority (ZATCA). ZATCA 2028 aims to play a role model in protecting the Kingdom by managing Zakat, Taxes, and Customs, promoting trade, and providing excellent customer experience.

E-Invoicing, also known as FATOORAH, is a streamlined procedure designed to replace traditional paper invoicing with an efficient electronic process. It enables businesses to electronically exchange and process invoices, credit notes, and debit notes in a standardized electronic format between buyers and sellers.

With e-invoicing, the flow of capital becomes streamlined, enabling businesses to unlock newfound agility and make informed financial decisions with ease. Suppliers no longer fret over late payments, as seamless automation ensures prompt settlement and strengthens those vital partnerships. Moreover, businesses can eliminate the hassle of manual paperwork and enjoy seamless communication, improved accuracy, and enhanced efficiency in their invoicing processes.

What benefits come with using E-Invoicing?

E-invoicing serves as a pivotal tool within the contemporary business landscape, enabling businesses to bolster the overall ecosystem.

By embracing e-invoicing systems, organizations can effectively mitigate hidden economy transactions, thereby curbing tax evasion through the reduction of transaction concealment. This approach fosters enhanced verification of business transactions, resulting in heightened tax compliance and streamlined tax administration procedures.

The advantages of e-invoicing extend beyond the realm of taxation and encompass an enriched consumer experience. Through the digitization of customer-business relationships, transactions become seamless, processes are optimized, and overall convenience is improved.

The adoption of e-invoicing empowers businesses to establish transparent billing systems that enhance consumer confidence and satisfaction. A more robust and transparent business environment is fostered by implementing e-invoicing technologies in convergence with the Zakat, Tax, and Customs Authority (ZATCA).

These cutting-edge tools not only promote fair competition but also combat tax evasion, foster tax compliance, and optimize the efficiency of tax administration. Furthermore, they pave the way for an elevated consumer experience, granting individuals greater convenience and trust within the digital realm.

What are the types of E-invoices?

According to ZATCA official guidebook, these are two main types of tax invoices:

1. Tax Invoice

-

Tax Invoice for Phase 1 (generation phase)

A Tax invoice is an essential paper for B2B and B2G transactions, encompassing specific fields defined in Article 53 (5) of the VAT Implementing Regulations and Annex 2(a detailed document to show the timelines and format for implementing the requirements) of the E-Invoicing Resolution.

During the Generation Phase, taxpayers must generate a compliant Tax Invoice using an E-Invoice Generation Solution (EGS), incorporating the additional data fields outlined in Annex 2. It’s important to note that converting a paper invoice into an electronic format does not meet compliance standards. Moreover, Phase 1 invoices can be presented to buyers in any electronic format, providing flexibility in sharing methods.

-

Tax invoice for phase 2 (integration phase)

During the Integration Phase (Phase 2), taxpayers generate Tax Invoices electronically using a compliant EGS after onboarding. These invoices should include additional data fields from Annex 2 of the E-Invoicing Resolution, preferably in XML format.

Taxpayers submit XML-formatted Tax Invoices to the FATOORA Platform via APIs for “Clearance,” undergoing validation and referential checks. Cleared invoices receive a Cryptographic Stamp and a QR Code before being returned. Phase 2 invoices can be shared with buyers in XML or PDF/A-3 format, ensuring compliance.

2. Simplified Tax Invoice

-

Simplified Tax Invoice for Phase 1 (generation phase)

A Simplified Tax invoice is primarily used for B2C transactions, following the defined fields in Article 53 (8) of the VAT Implementing Regulations and Annex 2 of the E-Invoicing Resolution. Annex 2 of the E-Invoicing Resolution specifies the fields that must be included in the Simplified Tax Invoice during the Generation and Integration phases.

If the combined value of the Taxable Supplies is less than 1,000 SAR, taxpayers could opt to issue Simplified Tax Invoices for the B2B exchange. For B2C transactions, invoices can be created for any amount, regardless of the value of the goods or services being sold. Moreover, a paper copy of the Simplified Tax Invoice must be provided to the purchasers in addition to the electronic version.

-

Simplified Tax Invoice for Phase 2 (integration phase)

Using an Onboarded E-Invoice Generation Solution (EGS), the taxpayer must electronically produce Simplified Tax Invoices with the extra data fields defined in Annex 2 of the E-Invoicing Resolution. Both XML and PDF/A-3 (with integrated XML) are acceptable formats for creating Simplified Tax Invoices.

The XML must be time-stamped with a CSID provided by ZATCA, and the EGS solution must include a QR Code that conforms to Phase 2 specifications. Within 24 hours after creation, taxpayers must submit Simplified Tax Invoices in XML format (not PDF/A-3) via APIs on the FATOORA Platform for “Reporting.”

The Tax Invoice will be checked for conformity to the XML Implementation Standard and other referential tests by the FATOORA Platform. The FATOORA Platform will return an API response after the Simplified Tax Invoice has been validated.

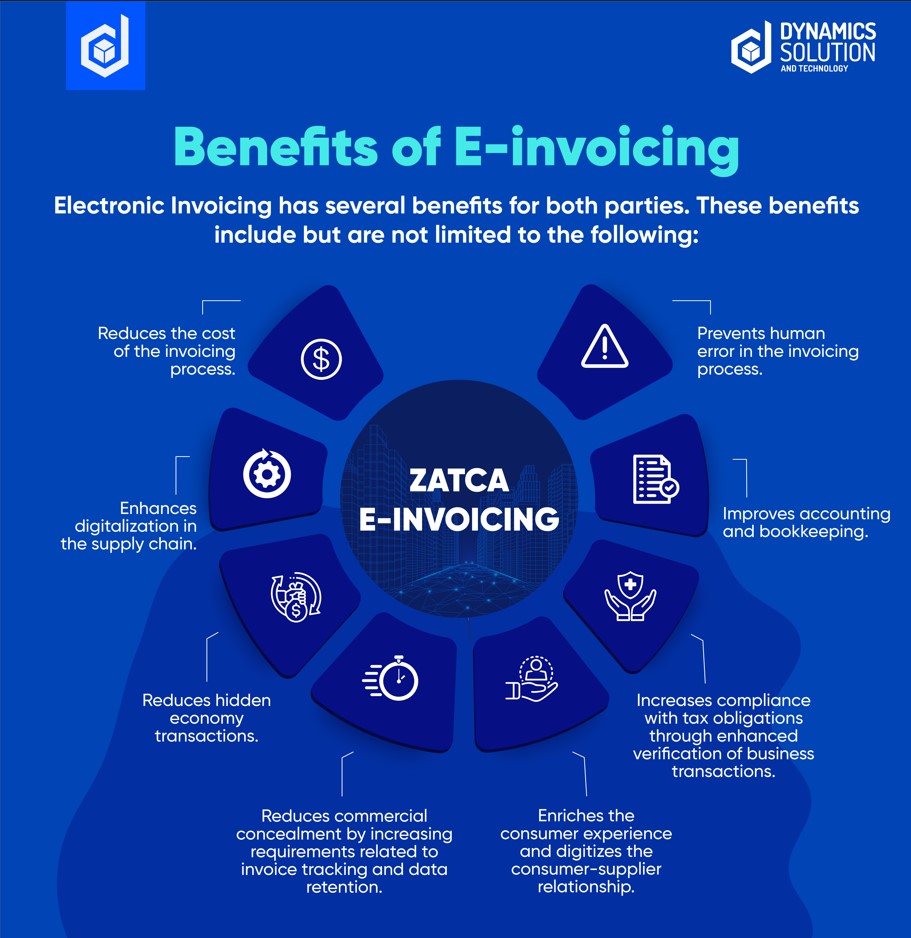

Benefits of E-invoicing

Electronic Invoicing has several benefits for both parties. These benefits include but are not limited to the following:

- Reduces the cost of the invoicing process.

- Prevents human error in the invoicing process.

- Enhances digitalization in the supply chain.

- Improves accounting and bookkeeping.

- Reduces hidden economy transactions.

- Reduces commercial concealment by increasing requirements related to invoice tracking and data retention.

- Enriches the consumer experience and digitizes the consumer-supplier relationship.

- Increases compliance with tax obligations through enhanced verification of business transactions.

Get Your ZATCA Compliant E-Invoicing Integrated Solution Today!

Get a firm grasp on the significance of ZATCA-compliant electronic invoicing. The government of Saudi Arabia has mandated that all businesses immediately switch from conventional paper invoices to the more modern method of creating electronic invoices.

To satisfy the requirements of ZATCA E Invoicing system, Dynamics Solution and Technology is now providing enterprises with an integrated solution. It is important to ensure that compliance with the new regulations is carried out without any hitches. Therefore, to avoid incurring fines, make the most of this chance to streamline your billing procedure. Fill out the below contact us form and get your business enlisted in the ZATCA e-invoicing businesses.