In December 2021, the Kingdom of Saudi Arabia (KSA) launched the initial e-invoicing system known as Phase 1 and gradually rolled out its second wave (Phase 2) in January 2023.

ZATCA E-invoicing system requires all resident taxpayers, consumers, and third parties that issue tax invoices to be included in the authorization group. They have announced the details of the required fields and formats to include in your e-invoices.

This blog will explain the compulsory fields for, ZATCA-Compliant e-invoices and business process changes needed for ZATCA e-invoicing Phase 2.

However, if you want your e invoices according to the Phase 2 guidelines, consider DS eFatoorah as your e invoicing integrated solution. It is a taxpayer-supported e-invoicing solution according to GAZT rules and regulations.

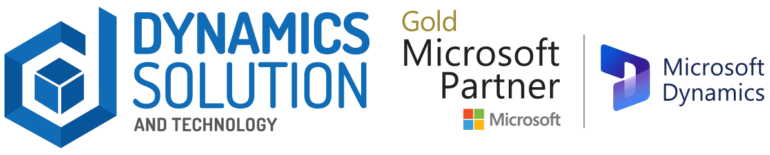

Phase 1 Standard Tax Invoice Compulsory Fields

For the first stage of e-invoicing in the KSA, taxpayers need to generate and save tax invoices and all credit/debit notes through electronic solutions compliant with ZATCA e-invoice requirements. Below is the list of the must-have fields in your document:

Phase 2 Standard Tax Invoice Compulsory Fields

In addition to the previously specified data, you need to include the following fields in Phase 2:

- QR code

- The additional seller IDs.

- Subtotal of line items

- Total invoice amount

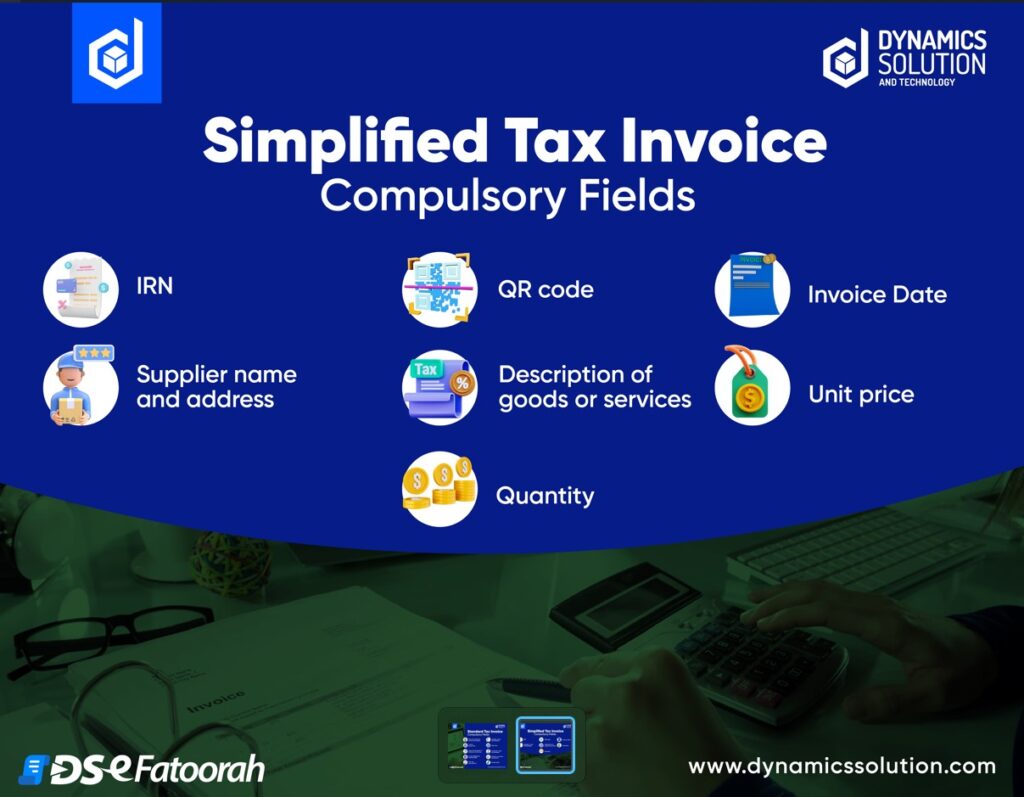

Phase 1 Simplified Tax Invoice Compulsory Fields

In Phase 1 of e-invoicing, sellers must produce simplified e-invoices electronically, transmit them to their buyers, and keep the Fatoorah for all transactions between businesses and consumers (B2C). Moreover, the document’s title must indicate that it is a simplified tax invoice, and it must have the following fields:

Phase 2 Simplified Tax Invoice Compulsory Fields

In Phase 2, The taxpayers are required to provide the subtotal of line items and the fields previously indicated on the simplified tax invoice.

Transform Your Business Processes for ZATCA e-Invoicing Phase 2

For taxpayers to adopt e-invoicing per phase 2 criteria, they should only need to make minor adjustments to their current business process. Here are the adjustments that you need to make to meet einvoicing standards:

- To begin, you do not need to make any major adjustments to your current invoicing process. The first step is to convert the paper invoices into e-invoices, which is what the ZATCA mandates.

- Secondly, to keep things running well, it is important to add the necessary devices and register them with ZATCA based on your business’s structure.

- It is possible that, as of now, you’re using bill format and data capture methods that are unique to your company. But, to use e-invoicing, you will need to map the fields on your invoices to the UBL 2.1 schema. Therefore, to comply with ZATCA regulations, you must update your invoicing format to include the compulsory fields.

- Moreover, you need to ensure that any invoice created in your accounting/POS/ERP system is uploaded and shared with ZATCA.

- You may need to upgrade your current invoice printing capabilities to add or remove fields that clash with ZATCA compulsory fields.

- For B2B transactions, you need to provide a PDF/A-3 electronic version of a tax invoice meeting all the ZATCA standards. However, for B2C transactions, you need to share a paper copy of the simplified tax e-invoice with a working QR code.

- You need to archive all your e-invoices for a period of six years to comply with ZATCA audit procedures.

Get a 100% ZATCA Compliant Integrated Solution for Your Business

Dynamics Solution and Technology‘s DS eFatoorah integrated solution has emerged as a trusted partner during these revolutionary advancements. We provide complete e-invoicing solutions to businesses like yours by following ZATCA guidelines and regulations. It will only take you one minute to fill out the contact form below. So, save yourself from hefty fines and get a ZATCA-Compliant e-invoicing solution today!