Businesses often cite cash flow management as a primary financial challenge because it’s a fundamental aspect of financial health. Even in a report by U.S. Bank, it is stated that 82 percent of businesses fail because of poor management of cash flow. Clearly showing the massive importance of finance management solutions like Dynamics 365 Finance.

Keeping a healthy cash flow means ensuring that your business has sufficient cash on hand to meet its costs, pay its debts, and invest in growth. One more important thing is that if you use an on-site finance management solution, you might pay hefty fees because of its cost and resource-intensive infrastructure.

Let’s first learn the foundations of cash flow and profitability. Then, we will have a detailed discussion on why you should invest in Dynamics 365 Finance.

What is Cash flow and Profit?

Simply put, profit is revenue minus costs—the sum remaining after deducting operating expenses from client revenues. Many business owners, whether young or old, view financial success as the ultimate goal of their operations. Actually, it is not! The tale of their prosperity does not just revolve around their profits.

Now that you know the basic concept, let’s learn about the solution that can help you streamline your business finances.

What is Dynamics 365 for Finance?

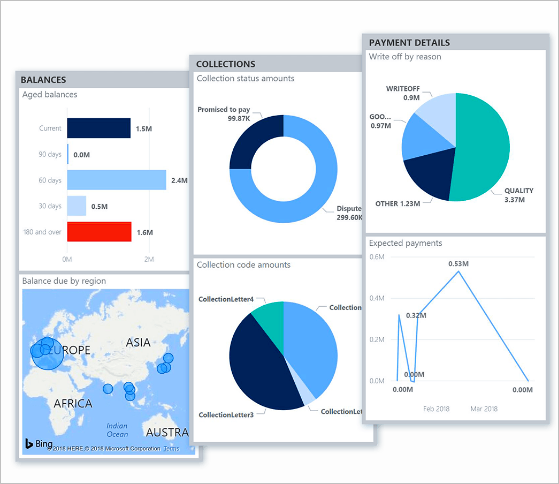

Microsoft Dynamics 365 Finance is a cloud-based ERP solution designed to empower businesses of all sizes with advanced financial management capabilities. It provides a holistic view of your financial data with few clicks.

Microsoft says, “It empowers business users to adapt to rapidly changing business environments. It provides businesses everything they need to control finances and manage funds with accurate information for financial planning and forecasting and helps them stay up to date with analytics tools.”

The Eight Main Benefits of Dynamics 365 Finance and Operations

Let’s delve into the compelling reasons why investing in Dynamics 365 Finance is a strategic move for your business:

1. Real-time Financial Insights

One of the core advantages is its ability to provide real-time visibility into your financial data. You do not need to sift through spreadsheets and wait for month-end reports manually. It will help you gain access to up-to-the-minute financial insights.

2. Hasten the Growth of your Business

With Dynamics 365 Finance, financial executives may stay competitive in today’s dynamic and ever-changing global market by leveraging built-in controls to obtain insight into their financial data.

3. Enhanced Compliance

Compliance with local and international financial regulations is a significant concern for your business. It helps you stay compliant by providing features like tax automation, reporting tools, and audit trails. This ensures that your financial practices align with legal requirements, mitigating the risk of costly penalties.

4. Scalability

As your business grows, your financial requirements evolve. This tool is highly scalable, adapting to the changing needs of your business. Whether you’re an SMB or an enterprise, this solution can grow with you, providing a future-proof platform for your financial operations.

5. Mobile Accessibility

According to Statista, “the current number of smartphone users in the world today is 6.92 billion, meaning 85.82% of the world’s population owns a smartphone.” It shows having access to critical financial data on the go is essential. Dynamics 365 Finance offers mobile apps that enable your team to stay connected and make decisions from anywhere, ensuring business continuity.

6. Confidentiality of Information

You already have heard cyber-attack news, which is getting worse day by day, And I’m sure that you do not want to be part of the news, right? So, for that, you need to adopt the best possible practices available right now that can not only save you from being vulnerable but also benefit your business with smooth operations. D365 Finance, with the integration of Microsoft Azure, can efficiently provide you with military-grade security.

It offers round-the-clock access to both catastrophe recovery and technical help. You may acquire the support you require with the aid of physical data centers, service hosting platforms, and network connectivity.

7. Customization

Workflow tools and modules are among Dynamics 365’s many pre-installed features. The marketing, customer support, field service, sales, and project service departments may all benefit from their assistance with automation.

The pre-installed utilities can be modified to better suit your needs if they don’t already do so. The program’s configuration tools allow you to make alterations, such as the addition of additional fields and objects.

The architecture of the software is also designed to be adaptable. The program’s flexible price structure makes it suitable for organizations of any size.

8. Achieve Superior Financial Performance

With Dynamics 365 Finance, a consolidated global financial management system that provides actionable financial insight and embedded analytics in real-time, you can expand your business profit margins.

Its interface is sleek and intuitive. Plus, you can operate it from any device or platform that is compatible with Microsoft’s software. It also enables your workers to work more efficiently and effectively with role-based workspaces and connections with other Microsoft 365 apps.

You already know that the most widely used application in the finance industry is no other than Microsoft Excel. For this purpose, Finance is happy to facilitate you in accessing your Excel data from any page in Finance with just a few clicks.

Through the use of centralized and automated procedures, Finance enables businesses to streamline the administration of their capital assets from purchase through disposal, efficiently track their values, and decrease reporting mistakes.

What is the difference between Dynamics 365 Finance and Operations and Dynamics AX?

By now, you have learned about the importance of cash flow management and the benefits of a cloud-based finance application. Let’s overview the differences between D365 and AX.

Dynamics AX used to be a powerful ERP solution; even some businesses are still using it without implementing new features. However, Dynamics 365 Finance builds upon its strengths and offers a more modern and user-friendly interface. It leverages cloud technology to provide greater flexibility and scalability, making it a compelling choice for businesses of all sizes.

Is Dynamics 365 Good for Small Businesses?

Absolutely! It is not limited to large enterprises. Its flexibility and scalability make it suitable for small and medium-sized businesses (SMBs) as well. SMBs can use it to automate financial processes, gain real-time insights, and improve decision-making, all without the need for a large IT infrastructure.

How Dynamics Solution and Technology Can Maximize Your Financial Flow?

Investing in D365 Finance is a strategic move for your business to enhance your financial management capabilities. It offers real-time insights, streamlined processes, enhanced compliance, tailored reporting, scalability, integration with Microsoft 365, and mobile accessibility.

With years of experience deploying solutions for businesses, Dynamics Solution and Technology understands your unique needs. We know that transitioning to a new financial system can be challenging. That’s why we offer a smooth and efficient implementation process.

Our certified experts guide you through every step, from data migration to user training, ensuring minimal disruption to your operations. Moreover, we are always there for you in case of any maintenance or support.

So, ensure not to let complex financial processes, compliance challenges, and efficient cash flow management hold your business back. Reach us here and revolutionize your financial operations to drive your business forward.