Businesses in Saudi Arabia are becoming attuned to the rules and regulations of ZATCA. This transformative change was initiated with the launch of Vision 2030, which aims to promote an inclusive private sector that prioritizes financial security to achieve compliance, productivity, and competitiveness.

Owing to the advancements in the financial landscape, businesses continuously digitize and automate financial processes to drive inclusive and long-term growth as they continue to play their part in the global macro-financial landscape.

However, change begins at the grassroots level. In the financial arena, the digitization of invoice processing (e-invoicing) has the power to bring unprecedented change at a national level. The people of KSA refer to e-invoicing as Fatoorah. It is a process allowing exchanges and processing of invoices, credit notes, and debit notes in a structured electronic format between buyer and seller using an integrated electronic solution. Nevertheless, these entire e-invoice processing guidelines are as per the directions of ZATCA, streamlining tax processing and adding transparency to invoice processing.

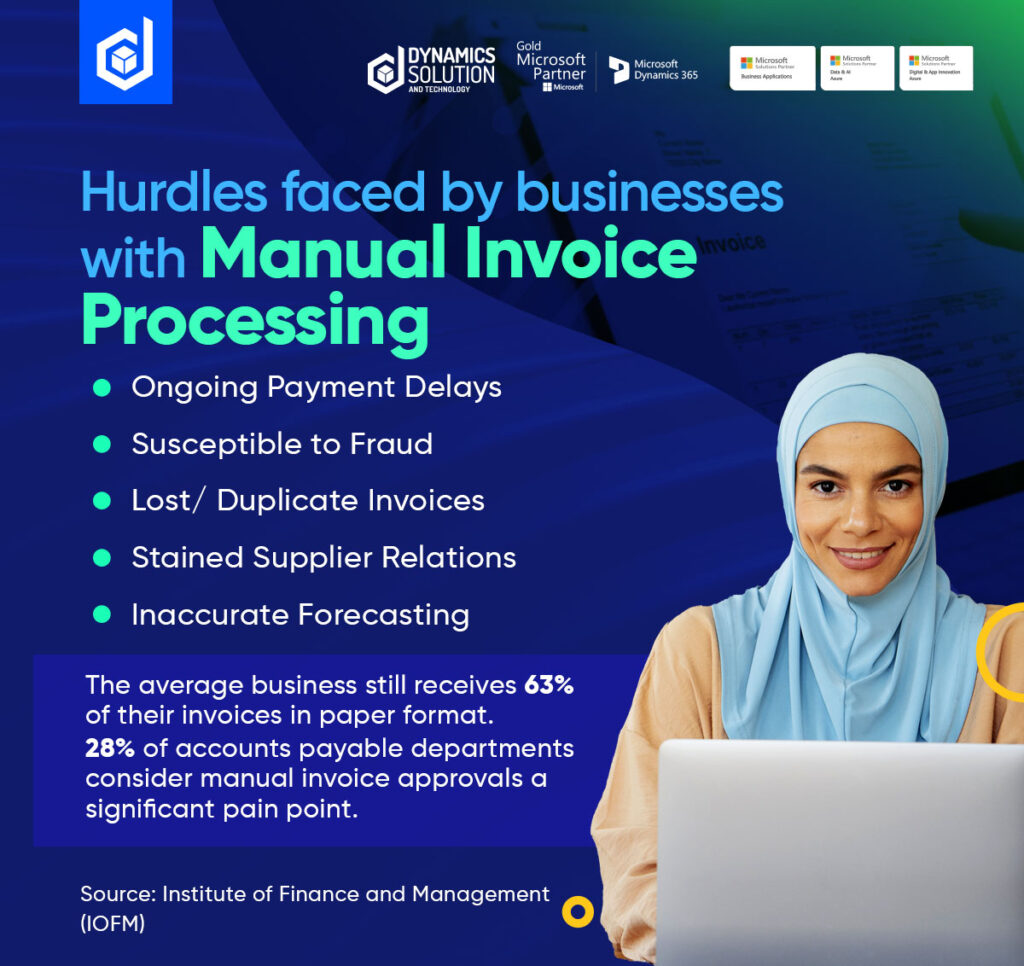

E-invoicing: A Move Away from the Manual Invoice Processing Challenges

Invoice processing dates back as long as the businesses have been operating. The nature of invoices has evolved, but it has always been a complex and challenging task. 77% of invoices received by companies are in manual format, such as PDFs, hard copies, faxes, or emails. In a perfect scenario, date, price, quantity, seller, buyer, etc. will find their way into the account payable stack. Together, they become numerous data variables that need processing simultaneously.

The manual invoice processing marathon begins with document preparation, routing, exception handling, data entry, indexing, approval, and filing. A slight mistake in managing these complex piles of numbers can take a toll on financial books and create havoc.

Here is a breakdown of the most common hurdles faced by businesses with manual invoice processing.

Payment Delays

Paper invoices often take time to be entered manually in a database. Approving them is time-consuming as well, especially when they go to multiple departments and end up forgotten in a pile of paperwork. This results in late payments that affect your supplier’s cash flow and your relationship with them. You miss out on early payment discounts and might even have to pay penalties. Also, the delay of payments is most often caused by invoice errors, which need to be corrected and rebilled before payment can be rendered which creates a lot of stress for finance teams.

Susceptible to Fraud

In a 2022 Global Fraud Study by the Association of Certified Fraud Examiners, fraudulent billing accounted for 20% of all fraud cases. The inefficiency in making and auditing the paper invoice puts the financial team at risk of fraud. There are too many gaps for such scams to slip away under the radar and can prove devastating.

Small businesses are particularly vulnerable as they typically have fewer reserves to bounce back from invoice fraud. Repercussions can include impeded workflows, stalled business development, customer trust impacts, and legal liability.

Lost/ Duplicate Invoices

It is natural for the invoice processing team to sink into a sea of paperwork and there will be more chances of losing invoices before they have been processed. In other cases, keeping a duplicate copy of an invoice also increases the chance of double entry, becoming as risky as losing an invoice. In both scenarios, the invoice is being processed manually, with potential mistakes that gravely alter the account books.

Stained Supplier Relations

An inefficient account payable process can affect the financial sector of a company in two ways. Firstly, the cost of processing a document manually can go as high as $15-18. This amount may seem to be higher than expected, but the entire process of reviewing tasks from the table seems quite justifiable. Also, the extensive and cumbersome account payable process can burn a hole in your pocket. Even if the invoice is an electronic document, then the manual process remains the same. Because the invoices are printed and end up the same way as the faxed documents.

Inaccurate Forecasting

The decision-makers need real-time data to make important decisions for a company. With the slow and tedious account payable process, real-time decision-making seems impossible.

Together, these hurdles take a toll on the financial standing of the business. E-invoicing provides numerous benefits in this regard.

How Does E-invoicing (Fatoorah) Benefit KSA Businesses?

Businesses have understood these complexities for a long time and have switched to the adoption of e-invoicing (Fatoorah) which provides immense benefits to businesses.

Efficiency and Cost Savings

- E-invoicing eliminates the need for paper-based invoices, reducing the costs associated with printing, mailing, and storing physical documents (also reducing carbon footprints).

- Electronic invoices can be generated, sent, and received much faster than traditional paper invoices, accelerating the payment process.

- Automation features in e-invoicing systems help minimize manual data entry, reducing the risk of errors and saving time.

Improved Accuracy and Compliance

- E-invoicing reduces the risk of human errors that can occur during manual data entry, leading to more accurate invoices.

- E-invoicing solutions often incorporate tax and regulatory compliance features, helping businesses adhere to local tax laws and regulations.

Enhanced Security

- E-invoicing systems typically provide secure encryption and authentication measures to protect sensitive financial information.

- The audit trail allows businesses to track and verify invoice history, making it easier to resolve disputes or discrepancies.

Streamlined Workflow

- E-invoicing systems often offer automation of the entire invoicing process, from invoice creation to payment receipt, reducing the need for manual intervention.

- It can integrate with other business systems, such as accounting software and enterprise resource planning (ERP) systems, streamlining the overall workflow.

- It also provides analytics and reporting features, allowing businesses to gain insights into their financial operations and performance.

Better Customer Relationships

- Quicker invoice processing and delivery helps businesses receive payments faster, improving their cash flow management.

- This adds convenience to customers, making it easier for them to receive and pay invoices, potentially improving the overall relationship with clients.

Cost Reduction

- By reducing the manual effort required for invoice processing, businesses can lower their operational costs.

- This enhances their ability to save time and money while enhancing compliance and security.

Overarching ZATCA Guidelines for Your Business

All the businesses operating in KSA are required to follow the rules and regulations of ZATCA. With the rollout of these ZATCA guidelines, e-invoice (Fatoorah) processing will eliminate the problems while staying compliant and transparent in invoice processing.

To begin with, businesses will have to make some adjustments to their tech infrastructure.

- Modify their accounting and invoicing software to support the issuance of an e-invoice in ZATCA-compliant XML format

- Configure their software to send e-invoices to a ZATCA-designated service provider

- Save issued e-invoices in the ZATCA-designated XML format

Starting in 2021, ZATCA rolled out two phases for the introduction of e-invoicing in the KSA:

- The generation phase that has already gone live on 4 December 2021

Being the first phase of ZATCA implementation, it requires taxpayers to generate and store tax invoices, simplified tax invoices, and respective credit/debit notes through a complaint e-invoicing solution. ZATCA implemented this phase on 4th December 2021. It is to be compiled by all taxpayers (excluding non-resident taxpayers) and any other parties issuing tax invoices on behalf of suppliers subject to VAT.

The procedures of issuing e-invoices will be similar to issuing invoices at present but through a compatible electronic billing system. The e-invoice shall include all the required items based on the type of invoice.

- The integration phase went live on 1 January 2023, with waves of integration targeting taxpayers with annual taxable revenue above a certain revenue threshold in 2021 and 2022.

It’s important to note that all business entities registered under KSA VAT, the customers, and the third parties who issue invoices on behalf of any taxable individuals must use electronic invoices. All VAT regulations applicable to tax invoices, credit notes, and debit notes continue to apply to e-invoices as well. However, non-resident taxpayers under VAT are excluded from the scope of e-invoicing.

DS eFatoorah: A ZATCA-compliant E-invoicing Integrable Solution

Businesses in KSA have a growing need to ensure that they are compliant with government mandates and streamlined tax processes. ZATCA provides two-fold benefits of ZATCA to businesses for introducing e-invoicing (Fatoorah) in KSA:

- Transparency in commercial transactions helps the government ensure better tax compliance.

- Electronically generated invoices help maintain better accuracy and effortless transactions with customers.

- e-Invoicing implementation increases efficiency in transactions for both businesses and governments owing to data standardization, seamless trade, speedy communication, faster payments, and reduced costs.

- e-Invoicing in Saudi Arabia allows the tax authorities to detect fake invoices or related malpractices and keep a check on the shadow economy.

Dynamics Solution and Technology reflects on the urgency of the businesses in KSA to update their invoice processing as per the guidelines of ZATCA with a compliant e-invoicing integrated solution.

Being an official ZATCA partner, it offers a swift, integrable solution, DS eFatoorah, which integrates with your existing or new ERP system effectively and efficiently.

- Adds ease of electronic invoice generation

- User-friendly dashboard with smart reporting

- Ensuring ZATCA-verified reporting to maintain compliance with tax regulations

- Data Validations to Avoid Penalty

- ZATCA Specific Invoice Format (UBL 2.1 XML format) for quick clearance

- E-invoice Share Service automatically emails APIs to share the A/3 invoice in PDF format

- Generation and authentication of e-invoice with digital signature

- Electronic archiving of invoices and their relevant data for a period of six years

- KSA-located cloud servers that operate based on SLA for complete E-invoice data

Compliant with VAT regulations and authorized for e-invoicing, DS eFatoorah meets all the Zakat, tax, and Customer Authority requirements. It is a comprehensive and end-to-end solution for you to become ZATCA-compliant in an easy and hassle-free manner.

Integrate DS eFatoorah today and become ZATCA-compliant!